Spotify claims 60% of top hits’ global streams

Spotify’s subscriber base is strong, with 236 million paid users, from a total market of 667 million, but that’s only one part of the story. Once we consider freemium accounts, songs’ availability and user engagement, the Swedish tech giant is responsible for 60% of global hits’ audio streams, ChartMasters found.

In November 2022, we at ChartMasters introduced an industry-leading feature based on internal algorithms, which provide a comprehensive view of audio on-demand streams for every artist. That is, combined streams from Spotify, Apple Music, YouTube Music, Amazon Music, plus 40+ more relevant platforms from all around the world.

Today, we’ve updated our model to remain true to the market conditions, this is due to various music streaming services going up or down, in incredible fashion lately. Ultimately, these scripts give us fascinating insights about how streams on Spotify convert on the other platforms, from the world’s biggest music stars such as Taylor Swift and Drake, to novelty and independent artists. We will conclude this article, listing how the recent market changes impact an artists’ streams.

Many reports suggest that Spotify’s market share among audio streaming platforms is around 30%. This figure is arrived at using a dodgy methodology, presenting an incomplete picture and using flawed comparisons, all together. Often, these reports are solely based on the comparative number of users, users being a very different notion from one platform to another.

This article tackles the subject in full, to give a real meaning to the music streaming industry. If you are an artist yourselt or a fan, it’s natural to wonder how many of your streams will come from where and obviously, how it pays off.

Come explore with us the current state of the music streaming market to see how Spotify’s market share really compares to other major players and what it means for artists’ streaming results.

The music streaming market in 2024

The blurry definition of a music streaming user

While the definition of a streaming user, seems pretty straightforward, the reality is far from it. Streaming platforms have a habit of using the same terminology, but not always in relation to the same thing, leading to a lot of confusion. We review the different natures of music streaming users and how they impact on those widely communicated statistics.

Premium subscribers

This is the actual number of people effectively paying for a premium subscription. As reported by the IFPI on their last annual market review, they have now topped 500 million worldwide.

Trials users

Statistics reporting premium subscribers tend to see a strong growth on Q4s. This is because they include users who are using a trial period – in general 3 months, with promotional campaigns often run at the end of the year – amongst premium subscribers.

These users are removed from counts once the trial ends, if they do not cancel their application to the service. Still, at any given point, when a streaming platform reports on xx million premium subscribers, a part of them never gave a cent and never will.

Paid users

Paid users refer to all users connected with a premium subscription. It effectively combines premium subscribers with additional users from duo and family plans. This is the statistics used by Spotify as their overall “subscribers” and listed at 667 million, by the end of 2023 by the IFPI. Off that, 236 million are from Spotify, meaning that they enjoy 35.4% of the total paid users market.

Paying users

I know what you are thinking: how the hell are paying users different from paid users? This variation comes from Chinese’s Tencent Music Entertainment company and the MiDiA Research company, to claim it as the 2nd biggest platform in the world, ahead of Apple Music.

Tencent, owner of QQ Music, KuGou and Kuwo platforms in China but also Joox in Southeast Asia and a large stakeholder in Indian’s Gaana, is a service of a different nature.

In China, platforms are all-exclusive. On QQ Music, one may stream music but also watch videos, download songs, purchase merch or live-stream a concert. It also embeds social media components.

Tencent’s paying users, as explicitly labelled by them, up to 106.7 million by the end of 2023, combine premium subscribers of the audio streaming tier but also anyone who has downloaded a song or bought some merch over the relevant period.

A previously linked financial report, mentions $1.7 billion from music subscriptions in 2023. Depending on how users are mixed between VIP and Luxury plans, it represents anything from 50 million to 67 million premium streaming users. A huge number but definitely not ahead of Apple Music, when speaking strictly about audio streaming providers. The same methodology applies to the other Chinese big one, NetEase Cloud Music and its 44 million paying users.

Bundled users

Throughout the years, many streaming platforms signed deals with companies to bundle their subscription service with another more expensive service. In the early days, Deezer faced bad press, as their reported number of Premium users were inflated because they included users who had subscribed through bundle subscriptions with telecom companies.

Being associated or not with something else doesn’t seem like a big deal. In truth, while technically these are considered as paying users, many do not use the streaming service at all, so artists should expect little streams from them.

In more recent years, we had two popular brands pairing their services with audio streaming access – Amazon and YouTube. The same issues surfaced. Amazon Prime subscribers artificially inflated counts of Amazon Music users, but not everyone, far from it, was actually converting to and using the music service.

Monthly Active Users (MAUs)

As their name suggests, Monthly Active Users (MAUs) reflect the number of distinct people who used the service over a rolling month, usually 28-days windows. All reports from Spotify report this statistic, which cracked 600 million over the last quarter of 2023.

This statistic doesn’t mean much in terms of revenue but as soon as streaming activity is concerned, it’s way more relevant than the amount of premium subscribers.

For paid-only services, their MAUs will be close to their claimed paid users, so platforms like Apple Music, YouTube Music or Amazon, will all be in the 70-100 million ballpark. Tencent’s financial results report a combined 576 million MAUs for QQ Music, KuGou, and Kuwo, although here too the definition isn’t entirely comparable. Indeed, they also include users watching videos or engaging on social activities, related to music. NetEase on its side climbed to 206 million in 2023.

Once we add every relevant service, which include SoundCloud, Pandora, Deezer, TiDAL, Fizy, Yandex, VK, JioSaavn, Wynk, LINE, MelOn, Genie, Flo, Anghami, Audiomack, Boomplay, KKBox, Joox, Zing MP3 and many more, the total is north of 2 billion.

Assuming that about a quarter of the total activity comes from Spotify, would still be an error. We will see why over the next few paragraphs.

Inactive paid users

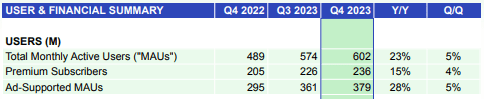

On their last financial report, Spotify announced 236 million paid users (Spotify labels them as “premium subscribers” but they are indeed paid users), 379 million ad-supported MAUs and 602 million MAUs overall. When we add 236 million to 379 million, we get 615 million, some 13 million more than the expected total.

These 13 million users are paid users (either premium subscribers or more likely, duo or family additions), who didn’t use the service over the last month. This is despite the fact that the engagement on Spotify is second to none. These statistics are available for this software but they are also telling for the other platforms: it’s not because they claim a certain amount of subscribers, that their MAUs is equally high, there are less users generating streams.

External users

In the mid-2010s, when music streaming platforms were exploding, it was a trending thing to claim huge MAUs, although some gross exaggerations like TiDAL’s or Deezer’s, backfired substantially..

Websites listing these claims as truths end up quoting 10-years-old figures in some cases, because the formerly claimed figure had never been topped, despite the exponential growth of the market.

A famous example is SoundCloud and its “175 million users globally in 2014“. The platform came to this figure by adding every distinct user who played a song from the platform – even when it was embedded somewhere else! It meant their active users were higher than the number of distinct people reaching their website.

Of course, as these were external users, there were no way to distinctively identify them, so playing a snippet from a SoundCloud embed, at different times or from different devices, would add multiple new users. We will see through the user engagement section, that the reality of SoundCloud’s activity volume is quite different to these old claims, which have been repeated again and again, for a decade.

Accounts

When trying to push the narrative that they were in a race with Spotify to be global leaders, Deezer communicated multiple times on large numbers of users. These came with no conditioning whatsoever, it was their comprehensive number of accounts, even those who got pushed to their database thanks to a Telco partnership and never made it to Deezer itself.

Ironically, some years later, a data leak revealed Deezer’s entire list of accounts: 228 million of them. It goes on to show how careful one may be when reading big numbers, as they took until their great recovery and their new, more liable positioning to hit 10 million subscribers in 2023, while monthly active users are about 3 times this number.

A user with no engagement is pointless

While the priority, some years back, was given to the number of users, streaming services understood that engagement was the key to becoming sustainable. Indeed, little engagement means high churn rates (the share of users leaving the service), small ad revenue and next to no premium subscriptions. When your prime marketing argument is enjoying unlimited music, the lack of consumption will always hit you back.

Engagement concerns explain why platforms vying to be sustainable like Spotify, Deezer and TiDAL constantly invest on new features. From playlists to podcasts to audiobooks to merch to technical improvements, making the experience the greatest possible, is mandatory to survive.

At the end of the day though, artists will get nothing from a platform where their music isn’t listened to and as we will see now, having the same number of users doesn’t mean the same volume of consumption, at all.

Lower engagement for different usages

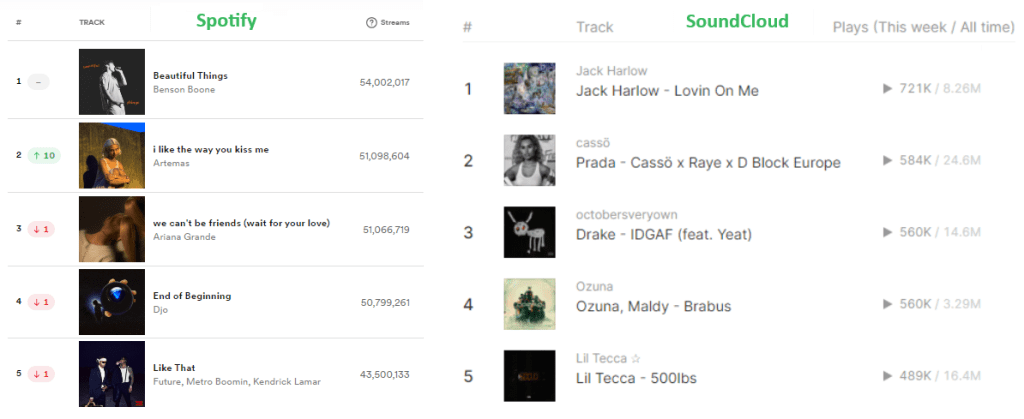

We quickly get a sense that all users aren’t worth the same when we compare charts from Spotify and SoundCloud. As previously stated, Spotify is now over 600 million MAUs, while we continue reading about SoundCloud’s 175 million users everywhere.

This simple empirical approach, which can be verified throughout the top 50, reveals that streaming numbers on Spotify are over 60 times larger than on SoundCloud. It means that independently of how many distinct people do use SoundCloud, the music consumption there is on par with the music consumption of 10 million Spotify users.

There is no shade intended to SoundCloud, it is a wonderful platform. Its market positioning is simply different from the ones like Spotify or Apple Music. People go there to discover great new independent artist, not to mass-consume hours of music through playlists during their daily routine.

While the media tends to portray streaming platforms as equals and like-for-like services, many differ deeply on their usage. One example is US-service Pandora, which once claimed 250 million accounts and peaked at over 80 million monthly active users. Most of those users still use it as a radio, with only a tenth of its users base, consuming on-demand music through the streaming subscription tier.

The impact of a user’s age

It’s no secret that youngters listen to more music daily than older streaming users. Many studies point out a 3-to-1 gap between Gen Z users and 55+ people.

Due to the way a platform acquires new users, they are bound to be younger or older than average. A good example is YouTube Music and Amazon Music. Both are similar, as they are streaming services bundled to premium services of a much bigger brand.

The situation is identical but it brings a huge difference to their user base, as the average YouTube Premium user will be quite a bit younger, than the average Amazon Prime subscriber. Millenials grew up with YouTube, while Amazon services hit Gen X the most. Once again, we will take an empirical approach to verify this situation.

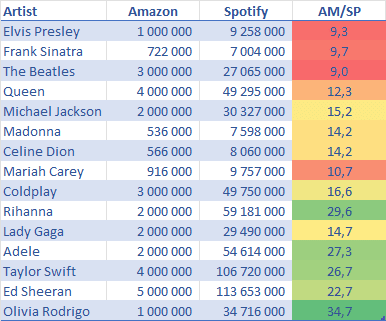

Let’s take a look and compare followers of artists from different periods, on Amazon Music and Spotify.

Artists from the 50s and the 60s like Elvis Presley, Frank Sinatra or The Beatles have about 9 times less followers on Amazon than on Spotify. The gap grows to 15-to-1 for 80s’ artists like Michael Jackson or Madonna, same with 90s’ glories. Then, as we reach 2010s artists from Adele onwards, the gap goes up to 25-to-1, and even 35-to-1 with Olivia Rodrigo.

These listening patterns reflect that Amazon users are indeed older in general.

Highlights also include the scale which goes from 9-to-1 to 35-to-1. At first sight, Amazon Music has about 6 times less users, yet the following is 18 times weaker. Interestingly, we see appearing, the same gaps in consumption from younger fans compared to older ones, with Amazon users engaging less with the content than Spotify users do.

Bandwitdh issues

Unlimited data is the norm on mobile subscriptions for richer countries but this isn’t the case everywhere. The global music streaming market picture also includes significant players, with a heavy presence in Sub-Saharan Africa, especially with the surge of Afrobeat music, led by Burna Boy, Wizkid, and Davido.

Coming from Nigeria, this music has been growing internationaly, with songs like CKay‘s Love Nwantiti and Rema‘s Calm Down becoming global hits.

If the local market is developing in Nigeria itself, as well as in other countries like Ghana or Ethiopia, bandwidth limitations continue to prevent these markets from exploding.

Two platforms are doing wonders in this region of the world: Audiomack, which also enjoys an international presence and Boomplay.

Delving into Audiomack’s statistics tell us that 59 distinct artists amass over 100 million streams there, 8 western artists, mostly US rappers and 51 local singers. Local stars Asake and Seyi Vibez lead with 1.46 billion streams, just ahead of Burna Boy at 1.43 billion.

When we look at the ratio between monthly listeners and total streams of these 59 artists, some fascinating results pop up. Among the artists scoring the most streams per listeners, the 8 international artists take the top 8 positions. Local artists with a solid reputation globally are just behind, Davido comes 9th, Wizkid 11th, and Burna Boy 12th. At #10 is Naira Marley, who’s half British.

The conclusion is simple: Audiomack users from North America or even Europe engage much more with the content, as they can enjoy unlimited data. On the other side, even the biggest fans of Afrobeat icons at home can’t stream them nearly as much, as their mobile subscription is capped.

Different platforms… different worlds

Geographical availability

Spotify often boast about their availability in 184 countries – basically everywhere bar China and then Russia, since the start of the war in Ukraine. So, when it comes to claims of having a global reach, they certainly can, as most streaming platforms are yet to be anywhere near this global.

Of course, there are countless of local platforms. The most notable of them are listed below:

- US: Pandora

- China: QQ Music, KuGou, Kuwo, NetEase, Migu

- South Korea: MelOn, Genie, Flo, Naver, Bugs

- Japan: LINE, AWA

- Southeast Asia: Joox, KKBox, Moov

- Russia: Yandex, VK

- Turkey: Fizy

- MENA: Anghami (although it’s deployed in other areas too)

- Sub-Saharan Africa: Audiomack (same as Anghami), Boomplay

- India: JioSaavn, Wynk, Hanguma, Gaana

- Indonesia/Mexico/Colombia: TREBEL

- Indonesia/Mexico/Brazil: TikTok Music

Inevitably, listening habits and popular artists, differ greatly from one region to another. If Chinese streaming platforms top Spotify’s monthly active users, it doesn’t mean that international artists are getting more streams in the former, than in the latter.

But even when we focus on global platforms, the lack of availability is a real story. TIDAL is almost entirely absent from Asia, even in Japan. If you are in Turkey, Russia, Denmark, Norway, Thailand, Taiwan, Hong Kong, South Korea or in the Middle East, you can’t use Amazon Music. Deezer too is missing in Russia, China and India.

A Japanese artist who focuses on TIDAL, thinking that they pay better than Spotify, would be very poorly advised. This caricatural example testifies the complexity of the market and that the raw number of users, is at times, a terrible indicator, to set up realistic expectations.

The price of western music

A given for western DSPs (digital streaming platforms), it may be a real challenge to include the international music repertoire for local unlimited music providers. Major labels are unwilling to license their music at the price of ad-supported streams in some countries.

Most notably, Indian platforms which used to claim hundreds of million users, are struggling to maintain international artists on their app. The wildest case came with Gaana. Once a leader, the 185 million users platform forecasted 600 million MAUs by 2023 just four years back. Now, they are below a million users.

After failing to be profitable and to raise capital, Gaana shockingly switched to a premium-only model in late 2022. This came as a real surprise, as paid users are extremely low on Indian platforms. While they have avoided mentioning their new user counts, since then, the last published financial results as of Q2 2023 revealed that 50% of their Rs 650 million revenue was coming from their premium members.

Considering their pricing (Rs 99 for a month, Rs 399 for a year), it implies at most 815,000 premium subscribers, if we assume they all use the cheapest option. In a platform where Justin Bieber is still showing 8.9 million followers and local legend Arijit Singh stands at 45 million, barely anyone is tuning in anymore.

TikTok’s parent company ByteDance launched Resso Music to much fanfare in 2019, quickly penetrating the market where deployed, namely Brazil, India and Indonesia. In 2023, it also turned premium-only and then completely shut down in early 2024. In it’s place the launch of the premium service TikTok Music was announced and as of now, available in Brazil, Mexico, Indonesia, Australia and Singapore. If the free tier quickly pushed Resso Music over 100 million installs on Google’s app store some years back, TikTok Music is struggling at only a million so far.

The lack of revenues in these markets, especially compared to the price of international music royalties, led many services to adopt a model where local music is available for free but global hits are restricted to premium subscriptions.

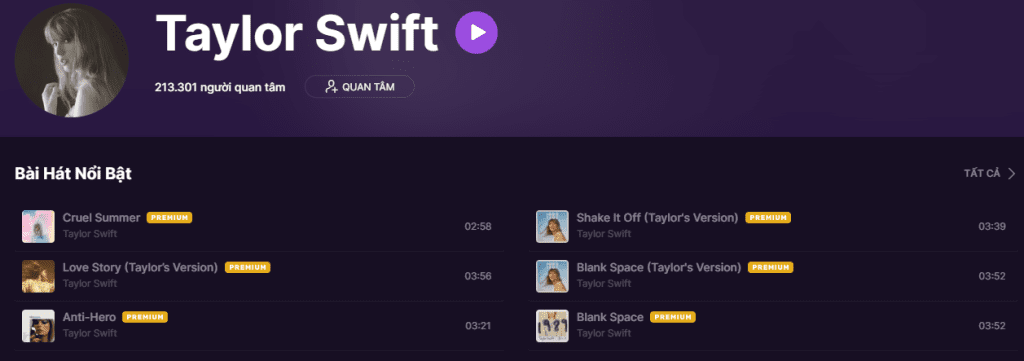

Anyone thinking that Taylor Swift is huge in Vietnam is correct – she claims 213,000 followers on Zing MP3, more than the cumulative tally of Lady Gaga, Beyonce, Adele, Rihanna, Avril Lavigne, Dua Lipa, Olivia Rodrigo, P!nk, and Mariah Carey. Anyone thinking that she is getting relevant streams on this platform would be wrong though.

As a matter of fact, Zing MP3 is one of many local platforms where we can see these Premium blocks in front of most international songs. The issue is, next to nobody is premium on this platform. This is just one example out of many.

On top of these difficulties to grant access to international music, majors also stopped releasing new music to Russian platforms since February 2022. It creates an awkward situation where Drake‘s last album on Yandex remains 2021’s Certified Lover Boy.

How artists perform in each platform

This article illustrates the difficulty of gauging the real popularity of an artist globally and how many streams they are enjoying. Lucky for you, ChartMasters did the work. Over time, we’ve built a model which feeds our streaming tools with audio on-demand streams calculations for all artists.

This model is focused on pure audio on-demand platforms. It therefore excludes platforms primarily dedicated to radio streams, most notably Pandora, as well as apps mixing audio, video and social media features, effectively Chinese platforms.

Spotify claims over 60% of the market

I introduced this article, quoting claims that Spotify’s market share of streaming music, of around 30%, were wrong.

In fact, our results reveal that the 100 most streamed artists in the world, record 59.77% of their streams on only Spotify. This share goes up to 60.97% when we look at the top 1,000 artists and even 61.96% for the top 10,000.

The increasing share as we go deeper into the ranking comes from the fact that Spotify is the most widely used platform. Artists from every genre, from all around the world can get significant streams there. Remaining platforms like Apple Music, Amazon Music, TIDAL, Deezer and all local platforms have unbalanced demographics. They are favoured either by fans of a specific music genre, a specific age group or a specific geographical area.

If we had a view on the top performing artists in each platform with numbers, the long tail would be weaker on these platforms, than on Spotify. Only YouTube Music can somewhat compare, although at a lower scale still.

Once we said that artists record over 60% of their streams on Spotify in general, we wonder who’s over- or under-performing this average. The good news is that we are going to tell you just that!

Case study: Taylor Swift

We will pick the case study of the #1 artist of the moment, Taylor Swift, to see how many previously described elements impact her results.

Running our algorithms, first in November 2022, showed that, by then, 58.29% of her streams were coming from Spotify. As of April 2024, this share is now up to 59.79%.

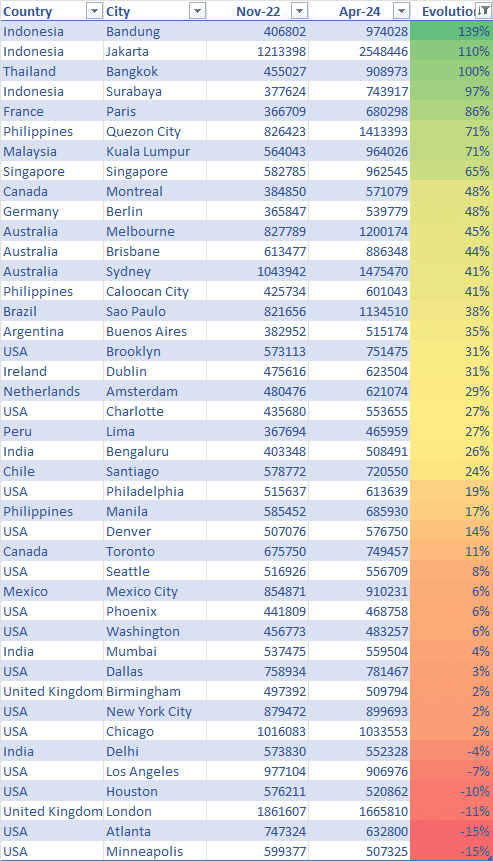

Below is the list of the 42 cities with a repeated presence on her personal top 50, on both dates and how listeners evolved on them in-between.

It may come as a surprise but statistics of the singer songwriter’s listeners in the US or the UK have barely changed. Some cities are slightly up, others slightly down. With a mature streaming market and the stability of Spotify’s position on them, it was bound to happen. As Taylor Swift is going just as strong as back then, numbers are mostly flat.

Apart from Paris, whose result is skewed, due to towns from the metropolitan area, being merged into the capital, the top 7 cities are all from Southeast Asia. It’s on par with numbers seen on Spotify Charts, where the cut to enter the top 200 charts from countries like Indonesia or Vietnam has been skyrocketing in the recent months.

Historically, Joox was big in this region. We’ve tracked app ratings for Joox and Spotify in Indonesia on both dates. In November 2022, they were on 1.2 million for Spotify, and 1.1 million for Joox. A week ago, Spotify was up to 1712k, up half a million, while Joox was at 1078k, meaning it is still on the same rounding as 18 months earlier.

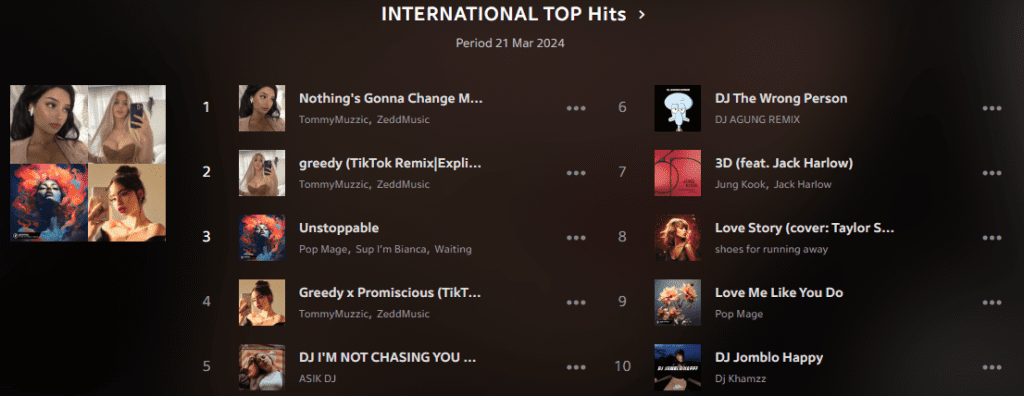

In recent years, foreign music has been completely pulled off the application. The top international chart is now full of unknown songs or versions, from artists with near zero followers:

Then, as previously mentioned, Resso Music was big there, claiming almost 20 million users at one point. Now, it is gone. These users switched to Spotify, which now claims over 30 million MAUs in the country, eating up a significant market share in recent months. The story is the same in the Philippines, Thailand, Malaysia and more.

The collapse of Resso Music, is the main explanation for growing results in Brazil, while booms in Australia are mostly due to late February concerts, which still impact monthly listeners.

On the other side, Latin American countries aren’t faring well. Spotify’s market share was as high as 85% in several Latin countries a couple of years ago. Since then, YouTube Music and Amazon Music have been recording good numbers, Deezer has been growing in Mexico and more importantly, TREBEL has arrived.

This new service, which uses a coin system similar to freemium mobile games, to get free songs downloads, is doing wonders in Mexico and increasing in Colombia and ultimately, reducing Spotify’s market share in these countries. .

Impact on artists’ global streams by genre

Our model defines over 60 artist profiles, based on geographical success patterns. It enables us to accurately gauge streams obtained by these profiles, in every country, tying that data to official certifications in order to complement the model.

Among the top 100 artists in the world, ranked by total lead streams, profiles which have seen the biggest changes over the last 18 months, are popular genres from Latin America, due to the aforementioned evolutions in the region. The top 10 Latin artists went from scoring 77.75% of their global audio on-demand streams on Spotify to 69.68%, meaning untapped streams from other platforms are now higher, rising from 28.70% to 43.55%.

Regional Mexican artists are also enjoying this phenomenon, with the genre leader Peso Pluma recording 68.37% of his streams on Spotify, a relatively small amount considering the historical strength of Spotify in Mexico. Apart from new streaming platforms, this is also the consequence of their increasing success overseas, especially in the US. In fact, Peso Pluma perfectly reveals the explosion of this genre, as he had yet to be added to our database less than 2 years ago, while he can now claim over 13 billion streams overall.

Naturally, local profiles from southeast Asian countries see their Spotify share go through the roof. Indonesian hero Tulus almost doubles, from roughly a quarter to half. It also impacts global pop stars who usually perform well in Asia, as illustrated with Taylor Swift. The gap is still minor, as the top 10 female pop icons go from 62.02% to 62.45% of their streams covered by Spotify.

The Top 10 US rappers are virtually unchanged, from 52.69% to 52.68%. It is the consequence of a stable share of Spotify in the US and a success overseas, on par with what they were already recording by 2022.

No streams, no money

When a leader is as strong as Spotify, people try to discredit them in order to challenge the top spot. For years, we have been reading countless times about how little the platform pays to artists. This is a lie. Indeed, the whole “pay per stream” myth is based on a gross misunderstanding.

If you are an artist, articles will tell you that for a million streams on Apple Music, you will earn about $8000 and less than that on Spotify. This is technically correct but in practice incredibly silly.

Why? Because this is based on average payouts through the world. It compares payouts of streams coming mostly from rich countries, to payouts of streams for artists from all around the world. Both pay from 60% to 70% of their earnings back to the industry.

If Spotify pays less per stream, it’s because they earn less per stream and if they earn less, it’s because it comes from users who don’t exist on Apple Music or from heavy engagement which dilutes the money per stream. But that’s also the reason why you’re getting more streams there. You can’t carry your million streams from Spotify to Apple Music, if there are no users available for that usage or if they barely stream anything.

Instead of pretending apples are oranges, let’s consider several situations to make it clearer. If you are…

- a pop singer aiming to get streams worldwide? For every listener you get on Apple Music, you will get the same premium listener on Spotify who pays just as well, plus 2 more premium listeners who pay a bit less each, plus 5 ad-supported listeners who won’t bring you much.

- a Latin reggaeton singer? You will get 20+ times more streams and about 10 times more money on Spotify than on Apple Music.

- an Indian singer? You won’t get a stream on Apple Music to start with as they have next to no premium users.

- a Swedish local folk singer? Your pay per stream on Spotify will be higher than Apple Music’s global average, as Swedes are mostly premium users and with a costly subscription ; no need to say you won’t get streams at all on Apple Music as it’s unused there.

- an American rapper? In the US, you will get slightly more premium listeners from Apple Music. But premium users from Spotify will be just as remunerative, the ad-supported users will make you earn more from Spotify in total still and with overseas streams the gap will increase significantly.

To sum it up, no matter where you live or which kind of music you do, Spotify will always pay you more.

The IFPI reported that the global recorded music revenues in 2023 were US$28.6 billion. Spotify paid out over US$9 billion by themselves. Add to that the exposure of getting big on Spotify, which almost grants success in remaining apps instantly, while increasing the demand for physical products or concerts and the answer to which streaming platform should I focus on the most? is a no brainer.

How we take these insights into our tools

Many of these unheard-of findings are incredible by themselves. But they deploy their full potential when impacting our various tools and rankings day by day.

ChartMasters’ streaming data tool

Everything starts with our beloved streaming tool, which retrieves daily song by song playcounts on Spotify, of artists as we use the search. Used by many labels across the world, who include various top artists on their roster, this pioneering feature has been shedding a huge light on the real success of tens of thousands of artists throughout the years.

If you want to benefit from these invaluable insights, prices are currently slashed by 50% so don’t miss your chance.

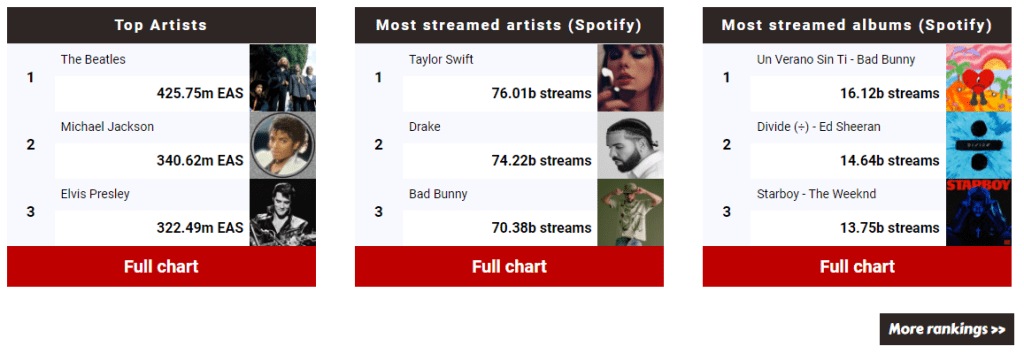

Most streamed artists on Spotify / on all DSPs

These artist-by-artist data concluded on the creation of the most streamed artists on Spotify ranking. The very first such list of its kind when it was introduced several years ago, it now leads the industry with more than 100,000 unique users who enjoy it every month.

With a backbone as solid as that, both with various data points on artists’ streams through the years and an incredible modeling of the streaming music market globally, we couldn’t help but build ChartMasters’ ranking of the most steamed artists across all DSPs.

We did so by applying the artist-specific Spotify streaming share to the related amount of streams.

For example, Eminem used to record 57.33% of his streams on Spotify by November 2022. It now is 56.65%. By the former date, his streaming total on Spotify stood at 31.2 billion, against 41.3 billion by the latter. Once we weight the shares with the attached playcounts, his career average stands at 57.16%.

Our streaming tools will then show that with 41.3 billion streams on Spotify, his combined audio on-demand streams across all platforms is valued at 72.2 billion.

The same process is applied to every contender, to build our amazing top 1,000 artists list.

Best selling artists of all-time

The need to create an automated environment to retrieve streams of popular artists came as ChartMasters is working on applying its Commensurate Sales to Popularity Concept to the most successful artists of all-time. To do so, we study in-depth sales in every format (albums, singles, downloads, audio and video streams) of major artists. And countless APIs, scripts, macros, have been developed along the road. All in all, we are able to produce comprehensive and accurate estimates of any artist’s commercial success, with a comparable scale.

This process to define and rank the best selling artists of all-time has no end in sight, as relative newcomers climb up the ladder year after year. As a matter of fact, artists like Eminem, Taylor Swift or Drake aren’t challenging the all-time greats, they are already among them. This is why it’s key to gauge streams accurately. It’s now far and away the dominant format in the music industry. For each of these artists, comprehensive breakdowns are available as shown by these links. Results of our algorithms detailed on this article will of course impact our upcoming updates to always get one step closer to accuracy, ChartMasters’ motto.

These detailed breakdowns also create many fascinating all-time tops reflecting pure sales of albums, singles, downloads, or streams, success indicators, etc. These are all accessible through our Rankings page.

Upcoming feature: streams’ income

Our model provides us a great view of artists’ streams country by country. The share of premium and ad-supported users by market is also part of it. With that, we are one step away from building a money’s list.

We estimate that over 3,000 artists’ catalogs generate over $1 million per year to rights holders from audio streams alone. How amazing would it be to put a number in front of each musician? Chances are ChartMasters will once again be the first place where you will be served with this feature.

Looking for a tailored solution to grow your career or your label? Get to talk with us.

We have more for you…

… about our original CSPC concept, which allows us to build a relevant full picture of any artist’s commercial success by factoring in all formats:

This article is being discussed in our forum, join us to share your comments! »