Are Apple Music streams underestimated?

It has been nearly 4 years since we try at ChartMasters to portray the global music market the best we can. A significant component of it is audio streaming that we value thanks to platforms like Spotify, Genie, AWA and Xiami.

A question arises frequently though. Are Apple Music streams underestimated for some artists when we use only Spotify to extrapolate their success in western markets? Artists like Drake and Taylor Swift seem to perform better on the former software, so do we need to adjust their numbers accordingly?

Why is the question worth asking?

There is a lot of false claims out there online, but we can’t deny that it is natural to question a method which uses Spotify to value streams on Apple Music. Here is why.

Urban music dominates Apple Music

If you have a look to the US Top 100 on Apple Music, you will see an insane domination from urban music. The screen shot below had to be done using Kworb, on a rather large screen and reducing the size of the web browser scale, in order to get a list deep enough to spot the first pop hits:

The first non-rap song is the R&B hit Playing Games by Summer Walker at 34. The first non-urban song is Someone You Loved by Lewis Capaldi way down at 51.

Ironically, the latter is immediatly followed by pop smashes Señorita and Bad Guy, making it look like the pop ranking starts outside of the Top 50.

These same 3 pop songs currently chart at 25, 23 and 36, respectively, on Spotify US.

To resume, there is no doubt that urban music performs better on Apple Music than on Spotify in the US. It’s true right now and it has been true basically ever since the service first arrived.

Availability gaps

Apart from the target audience which differs, there is also the availability which needs to be taken into consideration.

Multiple fans of Taylor Swift to name the most obvious example pointed out that extrapolating Spotify to estimate her Apple Music streams can only be wrong, because for some time she was available at the latter but not at the former.

The main complaints came during the 1989 era which saw the superstar openly criticize Spotify freemium model, taking off her catalog from the platform, and instead remaining available on Apple Music.

This led her album to be the 17th most streamed of the year in 2016 there while gaining 0 streams from Spotify.

Debunking myths

That a question is worth asking doesn’t mean the answer is obvious. From the previous two arguments, one would say that Apple Music impact on streams of someone like Drake has to be underestimated at this point.

Once we dig into numbers, we realize things aren’t so clear and that the Apple service is fairly missinterpreted by a lot of journalists and fans.

Below is a list of false myths floating around which corrupt our perception of the reality of the market.

The “Apple Music is bigger than Spotify” claim

In April of this year, tons of articles flooded news sites stating that Apple Music had moved past Spotify in terms of subscribers. Here is one example from Reuters.

If we combine this claim to the better performance of urban artists there, we are led to believe they are indeed amassing way more streams than one would expect and that we do calculate when factoring Spotify by roughly 1.5.

There is also a lot of articles which copied Billboard statistics which said that Spotify was growing 32% a year against 50% for Apple Music, suggesting the latter was going to crush the former.

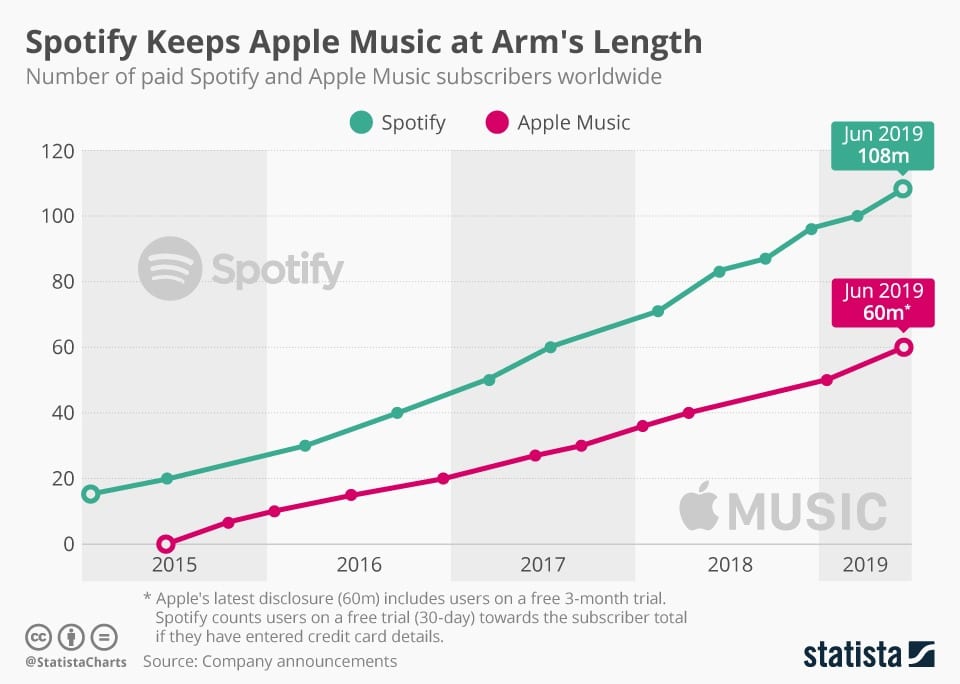

All this is wrong. In fact, Apple Music moved ahead of Spotify in the US only, and it did so in terms of paid-subscribers only.

As of last month, Spotify had 32.4 million premium subscribers in North America but also 32.6 million free ones, accounting for the US and Canada.

Thus, even if Apple Music is indeed ahead by a pair of millions in premium users, it has a near 30 million deficit in freemium users. It’s hardly a fact we can overlook when looking at the volume of streams.

The growth data is also dubious to say the least. They use a percentage, but Apple Music is coming from much lower numbers. They also once again ignore freemium users. Last but not least, the 32% against 50% numbers weren’t based on the same period, they cover 12 and 14 months, respectively.

Apple Music went from 40 million to 60 million paid subscribers between April 2018 and June 2019, a gain of 20 million users.

In the same time frame, Spotify premium users went from approximatively 75 million to 108 million, an increase of 33 million. All inclusive, they went from 175 million to 232 million users, a huge jump of 57 million users, nearly 3 times more than Apple Music.

These numbers also mean that in general terms, at 60 million against 232 million, Apple Music still has nearly 4 times less users than the Swedish giant.

Drake’s Scorpion was “streamed more” on Apple Music

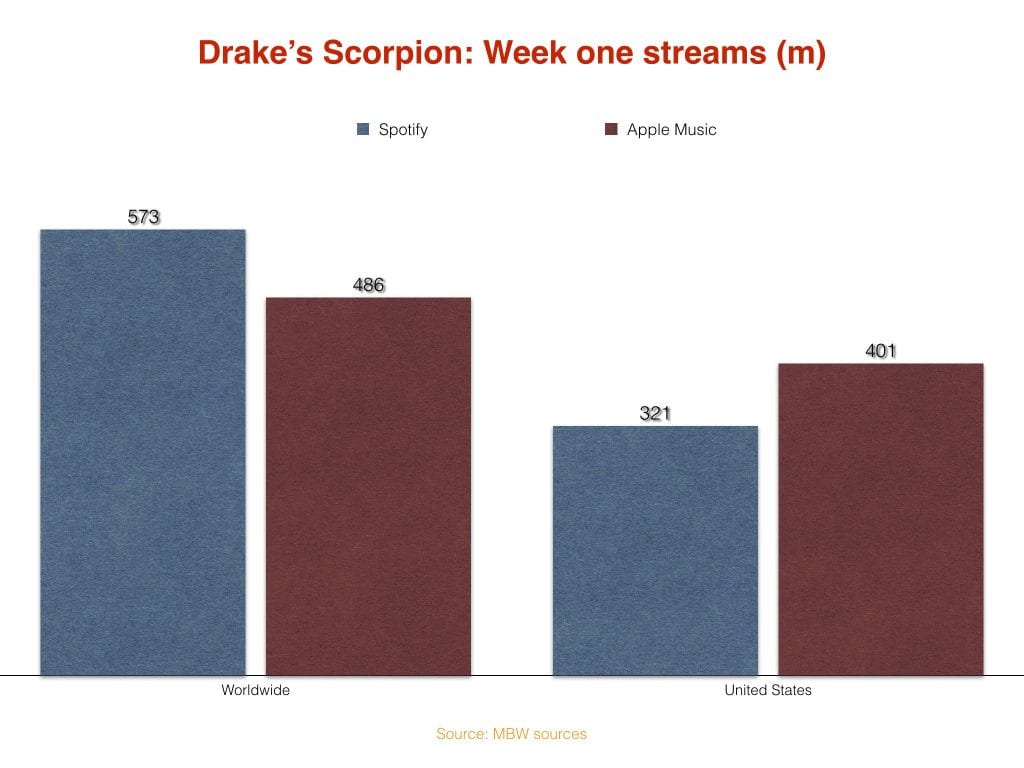

One may say that no matter how many users each platform has, Drake‘s Scorpion, the biggest debut of all-time on both applications, registered 401 million streams on Apple Music against 321 million only on Spotify in the US.

How is it possible considering it has half the number of users there? In one word: playlists.

They are a crucial element on Spotify. A lot of algorythm-generated playlists are largely enjoyed on this platform, making it one of their best selling arguments.

About two thirds of Spotify streams are hit using them. It means that when you drop a new album, you are virtually reaching only one third of their users.

On Apple Music, users will be way more tempted to reach the artist page and stream an entire new album.

That’s why while DaBaby dominates both platforms right now with his new release, the first track of the record Intro is #1 on Apple Music, while BOP leads the way on Spotify, the song that is listed first inside the hugely popular RapCaviar playlist.

This situation conclude on numbers that can go through the roof more easily on Apple Music, while the whole Spotify world is harder to shake, streams are distributed to countless artists through billions of playlists.

That the higher region of charts can take a larger share of Apple Music streams also means that lower down the ranking numbers are weaker.

Ultimately, a song can be #50 on Apple Music and #70 on Spotify but still register more streams on the latter even in relative terms. They are more balanced through all positions.

If we go back to our example of Scorpion album, it debuted with 321 million streams on Spotify out of 746 million in the US, a share of 43%.

It closed the year with 4,572 billion streams there, with approximatively 2,225 billion coming from Spotify. If we take first week numbers off, it means the share of this platform grew to near 50% in later weeks despite rankings still showing a better performance elsewhere.

The growing share of Spotify through months also imply that streams of Scorpion on Apple Music were more frontloaded. In fact, this was even visible the first week itself since the record got 29% more streams on Apple Music during the first day (170 million against 132 million) but only 22% more for the rest of the week (231 million against 189 million).

Ultimately, even in the US, Drake‘s 2018 album hasn’t amassed more streams on Apple Music, it’s just that streams there are more hyped upon release while they are less volatile on Spotify.

True in the US doesn’t mean true globally

If we go back to the previous MBW article, another interesting set of data is the numbers which stand for worldwide results. We show them below.

Wait! Wasn’t urban music massively dominant on Apple Music? It’s true in the US, not elsewhere.

Scorpion scored on Spotify 252 million streams outside of the US against a mere 85 million on Apple Music.

We mentioned that Señorita is #23 on Spotify while only #52 on Apple Music to show that pop hits are bigger on the former.

These rankings are US rankings. In Brazil for example, Señorita ranks at #21 on Spotify… while it is #1 on Apple Music.

Dance Monkey by Tones and I, a pure pop hit, stands at #63 and #233 in the US on both platforms, but actually charts higher on Apple Music than on Spotify in various countries like Germany, Italy, Spain, Sweden, Poland, Turkey, India, Indonesia and more.

So why do we assume that the US situation is valid everywhere? We tend to go by the easiest way to check chart results.

Unlike Spotify, Apple Music doesn’t provide a global ranking, so by laziness when we want to know what’s hot there we have a look at the American chart, since it’s the biggest market. It doesn’t mean it’s reflective of the others at all yet.

Apple Music actually behaves, expectedly, in the same way as former iTunes chart.

A few years ago, international artists where always performing much better relatively speaking on downloads than on physicals in countries like Germany, France, Japan, etc.

Downloads were also more frontloaded than physicals, with people rushing to buy the new album of their favorite artist from midnight.

The Apple audience had and still has a lot of people who like to see themselves as trend setters, as influencers.

The Brazilian influencer will be more likely to listen to international pop stars than a random person from the country.

The American influencer will try to know the new fresh rapper before anyone else.

That’s also why downloads used to be more frontloaded, because it’s a profile of consumers who are part of the hype way more than the average consumer.

So, are Apple Music streams underestimated?

Where do remaining platforms stand?

To understand how relevant Apple Music streams are, it’s key to know also the strength of the remaining competitors.

There is articles claiming fast growth for Amazon Music with 32 million users. PS: this is a claim, take it with a pinch of salt. Tidal is still around, while Deezer has 14 million users.

We already pointed out that Scorpion got 722 million combined streams from Spotify and Apple Music in the US. It’s market-comprehensive total was also revealed: 745.9 million.

In concrete words, the artist recorded a mere 3.2% of his streams on every other platform combined, massively underperforming market shares even for the US.

This situation is fully expected. Just like the US target audience of Apple Music is a perfect match with Drake‘s audience, it’s the opposite for several other services.

For example, Amazon Music has a share of users aged 55 and older over 3 times bigger than Apple Music and Spotify. Country songs also strongly over-perform the market there.

Just for fun, try it yourself: type in DaBaby on Amazon’s search bar. Chances are the Autocomplete won’t lead you to products related to the rapper, but instead to “DaBaby poster” in the Home & Kitchen category!

Cumulative numbers of Drake

Our method suggests to multiply Spotify numbers by 310/207 to account for users from all platforms of western markets, roughly 1.5 as previously stated. Asian markets are added on their side, same for YouTube views.

This article already tried to understand how many streams Drake was getting from all platforms.

Indeed, back in August 2018, his label claimed 50 billion streams. The caveat relies on features as these raw claims are never detailed. Were songs like Work or What’s My Name included in this total?

The musically article points out 19.9 billion streams by the date of publication as well as 4.7 billion YouTube views. Apple Music communicated a pair of weeks earlier 10 billion streams for the artist.

Considering shares of these platforms previously highlighted in his case, we can safely say that he hasn’t got 15 billion streams from remaining services.

Instead, when we posted his streams up to October 2018, songs from his artist page had climbed to over 21 billion, while his songs listed under the “Appears on” section were up to 7.9 billion.

These features also added for a huge 9.3 billion views on YouTube. That’s 10 + 19.9 + 4.7 + 7.9* + 9.3* = 51.8 billion. Figures marked with * were retrieved 3 months after the 50 billion statement.

Once we do the math, it appears that the claim included over 36 billion audio streams, with over 27 billion of them coming from Spotify alone.

If we take the 50 billion total at face value, our conversion is actually inflating him slightly, since 27 billion on Spotify equals to over 40 billion streams using the aforementioned formula.

It’s likely that the label claim wasn’t 100% all-inclusive, likely missing some features, since posted data confirms over 51 billion stream (even removing the 3 additional months for features) without adding about 3% to consider the remaining services. That would conclude on 39 billion streams, against the calculated 40 billion.

We need to remember that before growing in recent years, Apple Music had a negligeable share of the market in comparison to Spotify.

Until June 30, 2015, Apple Music wasn’t even around. Not too long after the arrival of the Apple platform, Ed Sheeran‘s Thinking Out Loud was already celebrating 500 million streams on Spotify.

Once we look at total streams of an artist with a 10-years long career, what matters isn’t the context right now, but everything which happened from the start to date. The formula balances it out.

Cumulative numbers of Taylor Swift

If we can demonstrate that streams of Drake on Apple Music aren’t as large as we one can believe, what about Taylor Swift who left Spotify from November 2014 to June 2017?

The key statistic here is again the number of users back in the day. As mentioned, by November 2014 Apple Music didn’t even exist.

When it started, even if it quickly gained millions of users, that was still a niche market in comparison to Spotify.

The service climbed to 27 million users by the time Taylor Swift restored her catalog on all platforms. It had an average of 11 million users during the 31 months of her absence from Spotify.

That is more than 20 times less than the current tally of the latter site. Another way to look at it, these 31 months on Apple Music were worth about 6 weeks of the current Spotify environment.

Not only that, before November 2014, Taylor Swift did amass significant streams on Spotify while Apple Music was still not there.

By the end of that year, they already enjoyed 60 million users, the same number reached by Apple Music in June 2019 and more than twice as much as their number up to June 2017.

In all likelihood, she gained much more streams on Spotify from the creation of the site to 11/2014 than she did on Apple Music from 06/2015 to 05/2017.

Another major element is that when she ultimately joined Spotify back in June 2017 to much fanfare, she got a huge extra jump there.

For example, 3-years old 1989 shot to #6 on UK’s top streaming album chart and lasted more than 6 months inside the top 50. Basically, it did get its streaming life on Spotify, it simply came much later. During this period it was way more popular there than on Apple Music

Is that enough to make up for years of absence in our extrapolation? No doubt, yes. Indeed, a 6-months boost on a 150 million users platform easily offset a 31 months absence from a 11 million users site.

What do numbers say? They tell us that without features and ignoring Lover, she gained more than 7.4 billion streams on Spotify to date.

On Apple Music, by March 2019, she was second to Ariana Grande among the most streamed female artists ever there, but that was still only good enough for 2 billion streams.

Even if we assume that she was closer to 3 billion than 2 billion, this still falls under the Spotify extrapolation since she had passed 6 billion by then, and there is still room for remaining platforms.

Conclusion

Dealing with formulas is always tricky. There is a lot of data to take into consideration and a lot of it can be confusing.

On the surface, it does appear that some artists may be stronger on areas that are not as well tracked as others.

There is just so many metrics through, so many different situations, so many different countries and so many different moments in a career, that more often than not market mechanics will remain valid, because everything balances out together.

The conclusion is that rather than adjusting specific cases, the most important focus must remain to set up formulas which reflect the best the market as it is. Once this is done, time will tell and adjust data of all artists organically.