Understanding: Worldwide Estimations Information

Yesterday in the Frozen study I referred to Black Friday as the opening of the Holiday season. On the other side of the mirror it is also the final curtain call of the release schedule fever after three months full of major artists releasing new albums.

That busy season started like every year in late August with simultaneous releases from Celine Dion, Barbra Streisand, Britney Spears and

Florida Georgia Line. With the likes of the Beatles, Bastille, Usher, Passenger, Bruce Springsteen, Shawn Mendes, Bon Iver, Sum 41, OneRepublic, Norah Jones, Green Day, Kings Of Leon, Lady Gaga, Leonard Cohen, Michael Bublé, Korn, Elvis Presley, Pentatonix, Avenged Sevenfold, Alicia Keys, Bon Jovi, Alicia Keys, A Tribe Called Quest, Garth Brooks, Emeli Sandé, Sting, and Olly Murs among many others with all kinds of artists from many decades releasing new material over a 12 week period. This is without even mentioning all the major artists in specific countries.

This week was the last of that release mania with Miranda Lambert and Little Mix coming out big in some countries, but also two global albums heavily anticipated by Bruno Mars and Metallica. Labels also always keep a couple or more albums back to issue in the very last weeks before Christmas. This year it will be The Weeknd next week and the Rolling Stones the following week, but with way less volume overall than during the past months.

With such an intense activity the whole world surrounding the music industry gets hot, including charts and sales websites and forums. Many fans open the doors to such websites for the first time hoping to get information about their favorite artist’s last album performance. Sadly, even supposed chart experts are posting highly inaccurate data at the moment. Statistics on Mediatraffic, often used as the easy go to total, has gotten worse than ever with very amateur errors in most of their figures.

How come? With sales getting distributed in several formats, charts of all countries were adjusted with new rules, but none of them are using the same set of criteria. The result? When you check sales of your favorite artists you will find some breakdowns looking like the list below :

US – 305,000

UK – 93,000

Brazil – 15,000

Japan – 31,000

France – 48,000

Germany – 100,000

Poland – 10,000

Spain – 11,000

Sweden – 20,000

The problem? Each of those 9 figures is deeply different in nature than the other eight. Thus, the worldwide total will truly be only summing apples with oranges. I’m not afraid to state that lately Chartmasters.org has been the only site being consistent in its methodologies. If just like me you appreciate being accurate, the following pages will help you in avoiding various estimations traps. So, let’s get started!

I) The case of the US

Album sales in the US are being posted in two distinct formats. The first are sales as we used to know them with download and physical sales at retail of the album combined, this is often named ‘pure album sales’. The second figure posted by Billboard is the SPS, Sales Plus Streaming figure, which encapsulates pure album sales, 1/10 of download sales of all the album songs plus 1/1500 of streaming achieved by those same songs.

Old school chart freaks massively ranted against the second figure, arguing album sales and singles sales can’t be mixed. That’s fundamentally wrong as buyers always purchased songs only – depending on the era, what the available and more worth it format has been, or the album or the single, but in any case the average purchaser was looking for a song nevertheless. Thus, cherry-picking one popular single makes the buying of the full parent album completely useless. If the format is different, the function is the same, buying the song you like no matter if it is packaged with other songs or not, that are unknown anyway. Billboard. thanks to their deep insight of the music industry. fully understood that logic which is why they came out with the SPS methodology.

Still, if some people like their habits it is their choice, so pure album sales keep being posted. Why not? but then, adding them to other figures lacks consistency…

II) The case of the UK

Mate, you are done. In fact, if one decides to go by pure album sales only in the US – as done by Mediatraffic – then it is utter nonsense to use Official Charts Company figures for the UK. Why exclude voluntarily streams from the US figure to then remain inside UK statistics?

To avoid going into detailed technicalities, I’ll only mention UK album sales add together both pure album sales plus streaming of the album songs after reducing streams of the top 2 hits at the height of the other tracks streams. That still means streaming is counted into album sales figures, thus making it inconsistent with the US tally. If you ever consider pure album sales only for the US, you will need to estimate the portion of streaming sales from the UK total to deduce them in order to remain consistent.

At the start, that methodology looked better, respecting more the historical album format in itself. With reduced streaming and ignored singles sales, the impact of those non-pure album sales was minor at first. A couple of years later it is now obvious that method isn’t enough.

Let me list a few figures posted by Paul H at Haven website about UK Year To Date sales. In the album Top 20, we can see the following albums:

189,000 – Elvis Presley – Wonder Of You

174,000 – Twenty One Pilots – Blurryface

162,000 – Rihanna – Anti

159,000 – Rick Astley – 50

While both Rick Astley and Elvis Presley have got surprising and impressive comebacks, does anyone seriously consider they marked 2015 as much as Twenty One Pilots or Rihanna? Of course not. If you check this week’s Top 20 artist albums, you will notice 10 of them are from singers who are over 50 years old or dead, and 4 more are from singers in their 40s. Only 6 albums are from acts under 40 and that includes two albums released this week by Little Mix and Bruno Mars plus Coldplay with Chris Martin that will be turning 40 within a few months.

Up to 2014, no calendar year ever seen more than 5 1 million selling singles in the UK. Up to November 25, there is already 13 hits over 1 million for 2016, a tally which will increase to 16 or 17 by the end of the year.

All those elements highlight one fact – the album to singles weighting is poorly done. New technologies are strongly deflated by the methodology of album statistics which artificially inflates results of older acts. Another issue is too many streams and sales that functionally replaceed the album buying are rated as single sales, again artificially boosting single sales.

Nevermind whatever is your take on how valid each methodology is – be consistent for all countries.

III) The case of Brazil

From 2003, the Brazilian music industry has been printing in album packages codes containing the number of copies shipped. You will read AA10000, AB5000 etc. which will mean the first shipment in the country featured 10,000 copies while the second contained 5,000 units. Thus, on estimation breakdowns, you will see Brazil – 15,000.

Once again, this is strongly inconsistent. When both the US and the UK figures relate to retail sales to consumers, Brazilian figures refer to units shipped from the major to retailers. This largely inflates the position of Brazil in all such breakdowns for new albums, as often the first pressing only will be enough to fulfill the demand during several months or even the entire life of an album. The result is that what is being counted as first week sales may in reality be the entire era’s sales.

But there is more. Those pressing figures obviously count only physical units. Digital album sales are being incredibly ignored by all specialized sites about charts and sales. Now, think about two albums, the first one by a confirmed act who’s flopping hard, the second one by a newcomer who’s getting hits. You will get Brazilian figures similar to this:

Confirmed act flopping – 30,000

– AA30000

Newcomer smashing – 30,000

– AA2000

– AB2000

– AC1000

– AD5000

– AE5000

– AF3000

– AG2000

– AH1000

– AI4000

– AJ5000

Both albums sold the same, 30,000 units, right? Well, no. The confirmed act will most likely never achieve such a large first pressing if it flops hard. In fact, if no second pressing ever came, it’s because the first one is still not sold out. Ultimately, real sales will be likely somewhere from 10,000 to 20,000 units. Digital sales won’t be a relevant factor as such an album sells well to a relatively old fan base which buys the CD and that’s it. The newcomer clearly sold out various pressings requiring more and more new ones to be issued. As a newcomer, the artist is all the more likely to be hot in digital sales too, just like Rihanna or Katy Perry who may sell as many download albums as CDs. That newcomer is likely to sell anywhere from 40,000 to 80,000 units in total, four times more than the confirmed act despite displaying at first the same result.

If the same figure posted for the same market can mean such a different result, I’ll let you guess how little sense it makes to mix Brazilian physical shipment sales with figures of other countries.

IV) The case of Japan

A few months ago, I deeply went into Japanese album sales. I tried to point out all the traps of information coming from this market. Obviously, Mediatraffic hasn’t been reading it. Inside that article I mentioned digital sales which were being fully ignored by Oricon rankings. I concluded that section by stating “Adding by default 15% to all recent international albums to estimate digital sales isn’t optimistic at all.“.

Then, a couple of weeks ago Oricon started to run a Digital Album chart. Loyal to their awful habit of separating everything, they haven’t mergeed those figures into the main album ranking. In any case, my assumption from a few months ago appeared to be fully correct. Indeed, just last week Bruno Mars debuted at #6 on the main chart there with 20,704 physical copies sold. He also debuted at #1 in the Digital chart with as many as 9,090 downloads. We can see that not only the 15% minimum was correct, the fact international albums tend to perform better was also.

Of course, it doesn’t mean local acts aren’t selling well in digital format. Since the introduction of this new chart, Hikaru Utada‘s last album moved 44,000 physical units and 14,000 digital copies, a 30% addition. A few weeks before she debuted with 253,000 physical copies in Japan only, also selling some units elsewhere, also add to that missing digital sales, and you get at the very least 300,000 sales overall for the week. Yet, Mediatraffic estimated its worldwide sales on 265,000 copies, obviously ignoring the fact Japanese album sales were related to physical format only.

Now that this chart is available, Bruno Mars will get his 9,090 digital sales factored in. It is too easy to just jump onto the bandwagon when it comes. If you are aiming to be the reference, you must move one step forward before others. Collecting data isn’t enough, one needs to understand the data they are collecting.

V) The case of France

The French charts have always been messy. Full of typos and mistakes, they have also been severely lacking consistency. Today, it is near impossible to know what is the real official album chart. SNEP and Chartsinfrance both post distinct rankings as they were the official ones. All of them are valid, using the same official provider, but it is very unclear as to which methodology ranking is being considered as the main chart.

Both rankings are a mix of the US and the UK rankings. One of them is a pure album sales chart, just like its US counterpart. The other adds streaming to the mix while ignoring download track sales, just like the UK chart, although it does so with a different calculation. That latter is more favorable to streaming as plays are divided by 1000 instead of 1500, which inflates French album sales in comparison to the US or the UK figures. Once again, we are adding apples and oranges. The worst is likely the singles chart which sees download sales converted into streaming plays rather than the opposite, going against the method used in every other country.

VI) The case of Germany

Very little data comes out about Germany to say the least. Thus, all figures listed for this country refer to certifications only. The problem is that certifications are based on shipment rather than on retail sales. The nature of German information is closer to the one of Brazil in that sense, but there are still relevant gaps.

Among notable differences there is that the official certifications of Germany include both album formats, physical and digital. It excludes streaming though. Another difference is that this figure is published with a plateau-logic. For Brazil, each shipment figure is exact, we can know if the album shipped 26,000 or 27,000 units. For Germany, a Gold award representing 100,000 units shipped will in reality mean anything from 100,000 to 199,999 units. It may even represent more than 200,000 units if the major never applied for an additional certification, while the Brazilian figure is always available.

This German situation will be the same as the one of various more European markets like Austria, Switzerland and Hungary.

VII) The case of Poland

Polish figures will be German-like figures, in that they refer to certifications only. I listed it separately to highlight one more trap, the multiple discs factor.

Just like the US, Canada and Brazil, Poland used to certify albums per disc rather than per album. In other words, when a simple CD album required 10,000 units shipped to be awarded a Gold plaque, a double album was only needing 5,000 copies sold to receive the same certification.

In August 2015, ZPAV fully revamped their certifications to include new formats, mostly streaming, and used the opportunity to remove this multi-discs rule. This updated system is similar to the one of the RIAA adding both singles sales and streaming into album certifications. The main difference though is the factor, while in the US 1500 streams is equal to 1 album, in Poland they fixed the formula on 2500 streams = 1 album. The 10 to 1 download singles to albums ratio is the same in both countries.

VIII) The case of Spain

Let’s be honest, Spanish retail figures rarely came out. It has happened a few times though. At first, they look similar to the US pure album sales, counting sales at retail of albums in both physical and download formats.

If one has a closer look ar them though, they will notice Spanish retail figures fell very short of Spanish certifications. In fact, only 79% of retailers are accounted for. In no countries are 100% of the retailers scanned, but formulas are applied to get 100% of the market. This extrapolation formula isn’t used in Spain though, which leads to deflating their figures as they are incomplete.

IX) The case of Sweden

Sweden has a very special position in the music industry. They are an open door to the future. From a musical point of view, they have always been way ahead of anyone else in understanding popular music trends. From Blue Swede to Ace Of Base to ABBA, many cult acts came from this country, always with a sound way ahead of its time. Lately, they dominated the electro music scene with the likes of the Swedish House Mafia, Avicii, Icona Pop, Tove Lo, and Zara Larsson. Even more impressive, almost all big pop stars of the last 20 years like Britney Spears, Backstreet Boys, Lady Gaga, Pink, Maroon 5, Katy Perry and Taylor Swift were in reality hugely helped by Swedish producers like Max Martin and RedOne. The former is responsible for 22 US #1 hits, more than anyone minus Paul McCartney and John Lennon.

Sweden isn’t only ahead of others from a musical point of view, but also in an industry vision. It is no coincidence that Spotify is a Swedish company. It is also no coincidence that Sweden has been the first country to see treaming dominate its industry. By now, this format represents an unreal 86% of their market while singles, CDs, LPs, downloads, ringtones and music videos combined make up for only the remaining 14%.

As a result, figures you will find for recent releases in Sweden will be almost exclusively streaming figures in reality, with very few pure album sales. Once again, their calculation is different from that of other countries, giving rise to even more discrepancies. I often read breakdowns focusing on US pure album sales, because they don’t like the SPS approach, and then use Swedish certifications which reflect almost only streaming, how relevant is such a list?

Conclusion

I can go on with additional cases like Finland and their shipment certifications looking like retail sales and Korea and their format separations. Undeniably, national charts aren’t properly aligned. The conclusion to come away with is that taking various figures completely different in their nature and adding them with no adjustment is just wrong. When I first started this blog I pointed out how collecting raw data wasn’t enough, that it is needed to add an analysis layer. Countless sites collect data, but that analysis layer is still very poorly covered. I hope this article will provide some assistance in order to reach that understanding and ultimately get more accurate statistics.

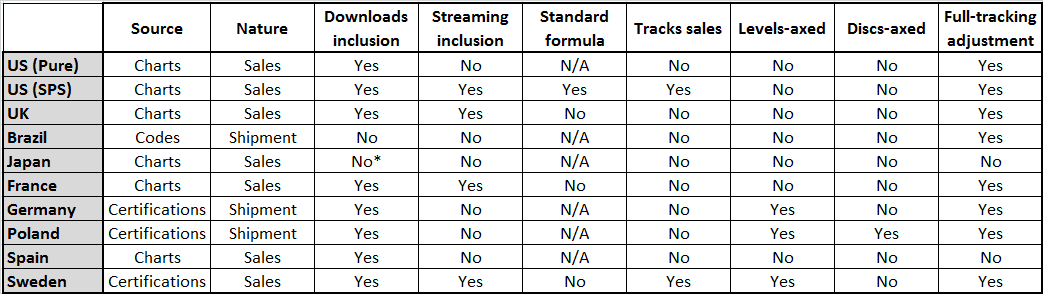

In the meantime, the below table summarizes the main differences of previously mentioned countries’ figures.

*Yes since 3 weeks

**Poland system pre-08/2015

Each and every time you read a sales number, my suggestion is for you to do the exercise of identifying all those parameters for the said figure. If that sounds too painful to do, well, you still have CSPC articles that erases all those problems to settle with consistent and comprehensive totals!

As usual, feel free to comment and / or ask a question!

Sources: IFPI, Billboard, OCC, Oricon, RIAJ, UKMix, Haven, SNEP, Charts In France, IFPI.DE, ZPAV, Media Control GFK, Promusicae, IFPI.SE, Mediatraffic.