Tuning of the CSPC formula

Ever since introducing the Commensurate Sales to Popularity Concept over 6 years ago, adjustments have been made to continue to be relevant with a market constantly changing.

As actors’ shares evolve and platforms become regulated, with Chinese sellers being a prime example along with YouTube, it requires our ratios for equivalent album sales to be aligned. In the same way, the overwhelming presence of features in today’s music industry must be addressed.

What’s the Commensurate Sales to Popularity Concept?

This method has been created at ChartMasters in 2016 in order to value the popularity of artists in a fair way, no matter when or where the artist has been successful, and no matter how his discography has been handled.

To do that, we had to deal with two challenges. The first was to treat the evolution of formats in use, from physical singles to blockbuster albums to downloads to streaming. The second was to deal with the various career managements, from artists with only studio albums to discographies full of compilations.

Artists Catalogs Generalization

The latter part has been addressed with a unique way of sales redistribution. Artists’ releases are split in two parts, the original material (studio albums plus stand-alone tracks called ‘orphan’), and recycled material (compilations, live sets, box sets, etc).

Sales from recycled material are redistributed into the original releases thanks to their relative impact as revealed by streaming services. For example, if a 10-million seller compilation has songs amounting to 40% of its total streams coming from the same studio album, we will consider that this studio album generated 4 million of its sales.

Format Generalization

The former issue related to formats is much easier to solve on surface, all it takes is to set up equivalent album sales by format. Up to date, this was our ratios:

1 CSPC = 1 album = 1 music video = 10/3 physical singles = 10/1,5 digital singles = 1500 audio streams = 11,750 video streams

In reality, this part is trickier as more and more sales avenues appear with time. Digital singles involves ringtones on top of downloads, the Chinese market has had a unique way of using downloads, there are differences in how streams and views are counted, etc.

If we zoom into the streaming sector, up to date, ratios in use were these ones:

Equivalent Albums Sales (EAS) = ( Spotify * 310/207 + Genie * 3.05*2 + AWA * 100/5.5 ) / 1500 + ( QQ views* 50(or 5) + YouTube ) / 11750

With Spotify (global, audio), Genie (South Korea, audio), AWA (Japan, audio), QQ (China, audio & video), and YouTube (global, video), being platforms used for their representativeness of certain distinct markets.

Why and how is the CSPC formula evolving?

Through the years, both actors and consumers of the music industry change their way of consuming, their way of offering music or their way of reporting.

For example, in August 2021, after years of madness, Chinese authorities dealt with the regulation of music sales, which completely changed the outcome in numbers. When this happens, our role at ChartMasters.org is to adjust our formula to get results in line with the real success of artists, rather than reflecting market technicalities.

These situations lead us to several formula adjustments from now on. We detail them below.

Distinct weighting for features

This question has been floating around for years: how features should be accounted for?

It seems clear that completely ignoring them doesn’t make much sense, just like weighting them on par for the lead singer and the featured singer also feels bogus.

To address this case, we used to weight the same for both artists for singles’ formats (physicals, downloads, streams), while album sales and related are owned only by the lead artist.

As album sales were dominant in the music industry until recently, this gave mechanically more units to the lead singer, and more important he was, more likely he was to sell a large number of albums.

Obviously, the big picture completely changed now. The music market is deeply different, with streams, a singles-axed format, dominating the field. With artists selling close to no album at all, featured acts end up with virtually the same total units than the leading singer.

To fix this flaw, from now on, featured acts, combined when there are several, will be allocated 50% of singles’ formats units. The lead singer will still get 100% of the total as before.

Thus, if a song has one featured singer, he will get 50% of the singles’ formats units. If there are 4 featured acts yet, each will get a fourth of these 50%, meaning 12.5%.

Then, we also need to detail what’s considered a feature.

Shared-lead credits are not concerned. For example, Señorita (Shawn Mendes & Camila Cabello) and Stuck With U (Justin Bieber & Ariana Grande) are duets rather than features, so each artist gets 100% of the units.

Featured acts which are in truth the lone singers won’t be regarded as features either. In the past, these songs were credited to the singer. A famous case is My Heart Will Go On. Everyone considers this song, as we should, as a Celine Dion track, as she is the lone singer.

Yet, the track is composed by James Horner and recorded for a James Horner project (the Titanic score).

Composers from the past are today’s DJs. Nowadays, when DJ Khaled, David Guetta or Calvin Harris release a song, they put themselves as lead credits and call “featured” act the one singing the song, from Justin Bieber to Rihanna to Katy Perry.

Most people would consider I Need Your Love to be an Ellie Goulding‘s song, This Is What You Came For to be Rihanna‘s hit, and One Kiss to be from Dua Lipa, just like we consider that My Heart Will Go On is by Celine Dion.

When the DJ puts together a multi-artist line-up, as DJ Khaled often does, we return to the standard situation with featured singers rather than a lone singer.

The only situation where the actual singer isn’t credited with 100% with the song’s units is when he is encompassed into the credited act, this happens for solo artists coming from bands. John Lennon won’t be credited the Beatles‘ sales, nor Michael Jackson, Beyoncé, Justin Timberlake, Harry Styles, etc., with their respective bands.

There are exceptions among exceptions, as side projects of singers are included into their career, we can mention D12 for Eminem or Tin Machine for David Bowie.

These definitions may seem complex, so below we use the case study of Beyoncé as she has songs of nearly every kind.

- Irreplaceable or Single Ladies: leading and only singer, she naturally gets 100% of their results.

- Crazy In Love (ft. Jay-Z) or Baby Boy (ft. Sean Paul): as the lead artist, she gets 100% of their results, while Jay-Z and Sean Paul are awarded with 50% of their respective featuring.

- Check On It (ft. Bun B & Slim Thug): still 100% for her as the leading artist, 25% for each Bun B and Slim Thug (50% combined).

- Beautiful Liar (& Shakira, from Beyoncé‘s album B’Day): shared credits, both singers get 100% of units from singles’ formats, while Beyoncé will also benefit from B’Day‘s sales.

- Until the End of Time (& Justin Timberlake, from Timberlake‘s FutureSex/LoveSounds): shared credits, both singers get 100% of units from singles’ formats, while Timberlake will also benefit from album sales.

- Perfect Duet (& Ed Sheeran): while the song was already famous as a solo hit for Ed Sheeran, this version has shared credits. Beyoncé gets 100% of singles’ units from this version, 0% from the remaining versions where she doesn’t appear. Ed Sheeran gets 100% from all of them.

- 03 Bonnie & Clyde (Jay-Z ft. Beyoncé): this time she features on the song and as such gets 50% of its sales.

- Love in This Club Part II (Usher ft. Beyoncé & Lil Wayne): 100% for Usher, while Beyoncé and Lil Wayne share the 50% allocated for features, so 25% each.

- Runnin’ (Lose It All) (Naughty Boy ft. Beyoncé & Arrow Benjamin): although Naughty Boy is a DJ, Beyoncé registers 25% of the song’s units as this is a multi-artists line-up, same for Arrow Benjamin. Had she been the lone singer, she would have got 100% of the track sales.

- Destiny’s Child‘s songs: of course, Beyoncé Knowles, the person, features on them. She is part of the parent act yet, so sales are owned by this act, the Destiny’s Child, rather than by Beyoncé, the solo artist.

- The Carters‘ songs: here we get into a post-solo fame side project, Beyoncé‘s contribution is worth 100% of the units.

- The Lion King: The Gift‘s songs: another post-solo fame side project, again Beyoncé is awarded 100% of the tracks’ units.

Removal of Chinese downloads’ specific rules

For many years, download sales from China have been one of the most controversial subjects among chart freaks. On surface, these sales seem just as legitimate as remaining sales.

When we dig into them, on top of being very, very cheap, they weren’t regulated, in a market with a heavy idol culture. As bulk purchase was allowed, fan groups quickly organized crowdfunding campaigns to artificially increase sales numbers.

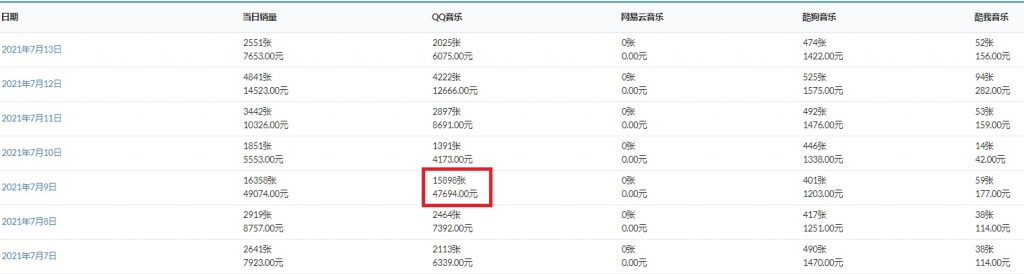

Below we illustrate this situation with daily sales of Xiao Zhan‘s Spotlight, which famously became the best-selling download of all-time with over 54 million units sold in China.

Here we can see that the track was selling roughly 3,000 units per day (column 2 is the total for all platforms), most of them coming from the QQ website (column 3).

On July 9, 2021, we see that sales rocket to nearly 16,000 sales on QQ alone, while they remain flat elsewhere. This is a clear case of bulk purchase. Most top sellers are full of these inorganic jumps.

Cheaper was a product, most important were these bulk purchases. To offset their impact, rather than considering numbers at face value, we weighted them thanks to their price.

The formula in use was to divide sales by the ratio between the price and 50. For example, a 1 million selling album available at 20Y, was awarded with 400,000 units (1m * 20/50).

From September 2021, the market’s regulation kicked in, blocking these mass purchases. Spotlight itself went from thousands to 500 daily sales. Days before the change, its sales shoot to 51,000 sales in 2 days as fans boosted it a last time.

This change brings two impacts. The first is that sales are now 100% legitimate. Naturally, for releases after September 1, 2021, we will now add these sales in full for every artist.

The second impact is that months following the rule change application revealed how much less sales of non-idol acts were boosted by artificial campaigns.

To account for this case, we will retroactively update our formula for pre-regulation releases as detailed below:

- old formula: CSPC unit = sales * price/50

- new formula: CSPC unit = sales * price/50 * (1 + NI*0.5) where NI = 1 for non-idols, 0 for idols

Idols are to be understood as the Asian definition of it, meaning that an idol act is a kpop, cpop or jpop group formatted by major local labels. No western artist fits this definition.

To be consistent with both singles and albums, both formats will follow these same rules, being fully counted after 9/1/21 and downweighed before this date based on the price and the artist type.

Change of ratio for YouTube views & Chinese streams

YouTube’s streams value

Both YouTube views and Chinese streams have been weighted at 11,750 plays per equivalent album sale ever since introduced.

In this case too, the weaker strength given to these clicks was due to the overall cheapness and how manipulated these numbers used to be.

YouTube has been trying to disallow fake views for nearly a decade. By 2013, bots were estimated to represent over half of the platform’s total views. This led the American giant to delete countless of dubious accounts and views.

While through the years YouTube learned to detect and block most bots, there are still heavy leaks on their methodology.

Firstly, click farms are a real business, employing thousands of people in low-income countries, as most publishers look for an uptick, with even artists expecting their label to push their videos when they are first released to create hype.

Secondly, there are private circles curating playlists so that their behavior seem legit, and exploiting the way views are counted almost instantly on social media with heavy sharing among their own accounts created for this matter.

Thirdly, many companies trick the system by embedding or leading to a video through a paid ads campaign. The infamous case of Badshah shocked the internet back in July 2019.

His song Paagal looked like an out-of-the-blue smash, recording 75 million views during its first day, topping previous global records from the likes Taylor Swift, Blackpink, and BTS.

A lot of people got suspicious about it, especially when YouTube failed to communicate the breaking of the record, something they usually do.

The shock got even bigger when by the end of the week, while the video viewcount was showing over 82 million views, the song was completely absent from the YouTube’s weekly top 100 chart.

The controversy got so big that the police investigated the case, forcing Badshah to admit he bought 72 million clicks in order to beat the global record.

The rapper felt the backlash was unfair to him. He wasn’t completely wrong, as the 3 previously mentioned record holders also embedded their music video inside an ad they paid-for, even if the Indian star brought the method to another level.

We can also mention Life Is Good by Future ft. Drake, which registered over 3 million daily views for 16 consecutive months, and then from one day to another saw its views drop to 300,000 daily in May 2021.

The booming revenue of ad-supported views

While these false counts are known cases, the most interesting part may be that YouTube is fixing them slowly, as shown with Life Is Good.

Many songs which have been registering dubious views for long are now getting their worst results in years, as illustrated by the meme track Dame Tu Cosita, with views dropping fast in recent months.

This led the IFPI to drop their headliner story line about the value gap, which suggested YouTube was bringing much less money than Spotify & Cie. In fact, the platform has been catching up this gap for several years.

It reached a point where in the US, both YouTube freemium and premium streams generate roughly the same value for the music industry as Spotify’s respective tiers. This is, of course, once we exclude views obtained thanks to ads, as these are excluding from royalties. Outside of the US, the gap is still kinda large.

This situation explains why Billboard charts covering the US use a 2.5 to 1 ratio between ad-supported and premium streams, while global charts use a ratio of 4.5 to 1 instead.

As a general note, it’s no coincidence if royalties on YouTube are booming while fake views’ proportions are weakening – now estimated to be from 15% to 20% of the total traffic. In fact, it’s deeply related, if views are more and more valuable, it’s because they are more and more organic.

The new YouTube ratio

While the exact YouTube ad-supported industry payments are unclear since their communications now include merged results with their YouTube Music audio streaming service, the estimate is that they almost tripled since we used this metric to set up our ratio, while the user base increased by only about 50%.

Almost doubling the strength of video views inside our formula, where they are currently set up at 11,750 to 1 album sale, would mean a ratio closer to 5,900 to 1.

As audio streams’ weighting compared to album sales is 1,500 to 1, applying the 4.5 to 1 ratio from Billboard would conclude on 6,750 views to 1 CSPC unit. Both approaches provide similar results.

We will see below that part of these views are somewhat double counted, so we need to take the most conservative approach to avoid it, which implies to go with the 6,750 to 1 ratio.

The dominance of YouTube in most markets as the prime video service is unmatched. It’s not true everywhere though, as many countries have their own services, on top of historical actors like Dailymotion.

It’s difficult to put a number on these varied websites and apps, especially as market shares wouldn’t help that much since users of local services consume more local material.

Numbers suggest that YouTube represents about 80% of the music video economy, to avoid artificially inflating western artists as most of the remaining 20% come from local actors, we are going to multiply YouTube views by 1.1 to get a full picture of video views for global stars.

Chinese streams

As they were of same nature – in good part video, free, and easily manipulated – Chinese streams have been valued on par with YouTube views. Now that we change the ratio of the latter, do Chinese streams require to be amended as well?

Our streaming masters articles point out that 96.4% of Chinese platform users were free when we introduced them.

Both giants NetEase and Tencent (QQ, Kugou, Kuwo) reported tremendous gains lately, with the former enjoying 28.9 million paying users out of 182.6 million, and the latter standing at 71.2 million paying music users out of 636 million. That’s 12.2% of paid-for users.

These users include both subscribers and users downloading music legally, and Tencent numbers also include a share of users from Joox, a QQ replica used outside of China, but the ratio still highlights a sharp increase.

Here too, just like with YouTube, the regulation of the market is making streams more valuable than ever, something that we need to reflect. For this reason, these streams will also be converted from now onwards with the improved ratio of YouTube views.

The extrapolation of Spotify playcounts to all platforms

For several years, we have been assuming that streams across audio streaming platforms were reflected by the formula below:

Equivalent Albums Sales (EAS) = ( Spotify * 310/207 + Genie * 3.05*2 + AWA * 100/5.5 ) / 1500

The logic was that Spotify had 207 million users at that point, compared to 370 million for all platforms, minus 60 million from South Korea, Japan and China, as we used dedicated platforms to reflect these markets.

While the overall market share of Spotify has been mostly flat for years, a change of only 2% or 3% still amounts to large numbers for today’s top artists.

On top of this, new actors from additional regions have been exploding. To make sure we continue to reflect global streams accurately, we review the situation region by region.

China

This market is already part of our panel, as mentioned and detailed previously, we will be using a 6,750 to 1 ratio for their streams. We will also stick to the method converting QQ views into general metrics for this market as it has been set up recently, and market shares remain in line with this.

Japan

Up to now, the method to estimate Japan was to multiply streams from local service AWA by 100/5.5, as this platform had a market share of 5.5%.

Since then yet, Spotify was deployed in Japan and conquered a large share – estimated at over 21% – of the market. As the Spotify number itself is multiplied by roughly 1.5 (as we seen, 310/207), it means we already cover approximatively 32% of the market.

Hence, local platform AWA needs to reflect only the remaining 68%. AWA’s own market share has been going down to about 4%. Therefore, the formula will be adjusted to AWA * 68/4 from now on.

Southeast Asia

This region is accounted for thanks to streams from South Korean platform Genie, multiplied by 3.05 to get a comprehensive picture of this country, and then again by 2 to extrapolate streams from the entire region.

The situation in South Korea is similar to Japan as here too Spotify has been rolled out. In this country yet, the Swedish giant remains a minor actor with a market share under 1.5%. In the rest of the region, the platform has been around for several years, enjoying much stronger market shares, even if Joox is the leader in several countries.

Thus, our Genie extrapolation doesn’t aim to cover these markets in full, but only local platforms, mainly MelOn, Flo, Naver and Joox.

Of course, it always requires to be careful when dealing with statistics impacted by idol fans, as they tend to be so enthusiastic about their favorite artist that they try to game the system.

Luckily, GAON, the official charts and certifications provider, enables to fix the flaws. Below is a table showing the last 20 singles certified for streaming, with their respective Genie and MelOn streams.

This table brings many interesting points. The first one is that both Genie and MelOn numbers are ridiculously high considering the real amount certified and the market size.

South Korea is on par with countries like Canada and Australia among the top streaming markets, about 3% of the global total each. On these markets, the truly big hits are in the 100 million to 200 million ballpark.

Taking the example of Kid Laroi & Justin Bieber‘s Stay, and considering that Genie and MelOn combine for 56.52% of South Korea’s streaming users, numbers from the table suggest that the track has 295 million streams to date there. The song was certified for 100 million last week yet.

We can also notice that this phenomenon is increasing. If a few years back a 3.05 ratio between Genie and Gaon was good to get realistic numbers, now the real ratio is about 2.20 instead.

The MelOn/Genie ratio reveals two more things. The first is that the share of a streaming platform isn’t that important, as for most songs a simple multiplication gives a realistic number of streams from one platform to another.

Results tell us that MelOn is more flawed. The more an artist belongs to the idol culture, the higher is the ratio. The trio of songs from BTS (Butter, Dynamite and ON) are massively inflated, with supposed streams on MelOn alone far higher than their total certified for the country.

That is even though their Genie numbers already appear to be too high when multiplied by 2.2.

In the other side, international hits like Stay, 2002, Peaches and thank u, next, along with local hit 바라만 본다 which is from a supergroup which has members on their 50s, have the weakest increases from Genie to MelOn.

If the least flawed numbers are the ones from Genie, it also means that this platform, although about two times smaller in terms of total users, is indeed better than MelOn to reflect the real numbers from this market.

The number of users from South Korean platforms and remaining Southeast Asian platforms like Joox is still similar, estimated at below 20 million each.

The previous Genie * 3.05 * 2 formula is thus replaced by Genie * 2.20 * 2.

India

The Indian market has several prime actors. Spotify is now very strong there, as well as other international platforms, but local apps Gaana, JioSaavn and Wynk Music are also powerful.

Their monthly active users up to date are likely to be around 200 million, 110 million and 75 million, respectively.

Does that mean that we need to almost double Spotify numbers only to estimate songs’ streams there? No, that would be a gross error.

Our CSPC articles treat mostly international artists, and Indian platforms ask you right from the start which language and which artists do you listen to. Local stars are massively dominant there.

Once we compare streams on Spotify, Gaana and JioSaavn for global hits, we notice that they actually get way more streams in the former, even if Spotify has only about a tenth of the remaining two in terms of users in India.

We can pick the example of the smash Stay once again, as it recently topped Señorita as the most streamed foreign song on Spotify India. Additionally, it never left the Spotify top 200 chart so its total streams are known, at over 104 million to date.

On JioSaavn, the track stands at 20 million, while it is over 30 million on Gaana.

Patterns are verified for most hits, with foreign songs registering slightly over 50% of their Spotify streams on local services. To extrapolate these platforms, it’s then required to simulate 15 million users (over half of the near 30 million Spotify users there).

We keep these 15 million pseudo-users in mind for now.

Obviously, if an Indian artist gets covered, we would directly retrieve his streams from local platforms.

Maghreb and the Middle East

In Arabic countries, global streaming platforms are now in use, as both Spotify and Deezer entered the MENA market in late 2018.

This bit is already covered with our standard Spotify extrapolation, we are missing the elephant in the room though. That one is Anghami, far and away the biggest audio platform in this region.

Claiming over 70 million users, this software has the good idea to display an artist total of streams. For example, Drake recently topped 250 million plays there.

To properly cover the region while keeping it handy, from now on we will use this number of total streams and spread it across the artist catalog as per Spotify distribution.

Sub-Saharan Africa

Poised to become a major market in some years, Sub-Saharan Africa is still in the early stages, but the booming internet and smartphones penetration is paving the way for music streaming services.

Two of them already own millions of users, Boomplay and Audiomack. Nigeria superstar Burna Boy claims 236 million streams in the former and 549 million in the latter.

For this market too, we will be using these totals to distribute them across the discography of the artist we study.

Russia

To retrieve information from their major music platform, Yandex.music, is pretty messy at the moment. Many international artists have been removed from their catalog, just like the Russian statistics got removed from Spotify due to the dramatic events ongoing in Ukraine.

For these reasons, and as the historical playcounts from Spotify and YouTube views already consider a part of this market, we’ll not add a dedicated service to reflect this market as of now.

Global markets

By global markets, I refer to market where platforms in use are global actors rather than local companies. These are North America, Latin America, Europe and Oceania.

Global streaming platforms, excluding radio services, include Spotify, Apple, Amazon, YouTube Music, Deezer, SoundCloud, Tidal, Napster, Qobuz.

As of now, we have been reflecting these platforms with our Spotify * 310/207 extrapolation.

By the end of 2021, Spotify was up to 406 million users, while the next 3 had an estimated 78 million, 68 million, and 50 million monthly active users, respectively.

Deezer stands at 16 million, while we can estimate Tidal, Napster, and Qobuz to be around 6 million combined.

On paper, SoundCloud has 175 million monthly active users. This isn’t comparable with the remaining platforms yet. SoundCloud has a strong social media component, people get there to listen to some specific new mix, not to stream playlists for hours.

Once we compare streams from songs of artists equally popular on both sides, numbers from SoundCloud are more in line with a 10-ish million streaming platform.

We also need to consider the 15 million users required to reflect local Indian music providers.

There’s a last trick to address before knowing the appropriate ratio to set up. This is YouTube Music’s 50 million subscribers.

Technically speaking, their streams are already accounted for as they increment YouTube views of the associated video. If the streams are already counted, we may think that we can ignore these 50 million users.

They represent a minor share of YouTube views, which are downgraded due to the multiple reasons we listed above. This is hardly reflecting real audio streams from YouTube Music’s paying subscribers. We also used the conservative approach (6,750 to 1 ratio) in order to avoid double counting these users.

In fact, we did so because instead of increasing the YouTube views conversion rate to account for these proper audio streams, we will extrapolate these users thanks to Spotify streams.

While this can feel weird, Spotify streams are more reflective of YouTube Music streams than YouTube views, even if YouTube Music streams are encompassed into them.

Think about Despacito. The song is soon going to hit 8 billion views. When it was smashing, YouTube Music wasn’t even around, although they absorbed some of the rare Google Music Play users.

Assuming that a good chunk of these 8 billion views from the poorly regulated era of YouTube are reflective of YouTube Music streams would conclude on strongly inflated numbers.

Furthermore, the strength of YouTube lies on its incredible strength in low-income countries like India. At its end, YouTube Music, a paid-for subscription, has its best markets in the same regions as Spotify.

Users’ behavior differs too, with most YouTube users going after the big hits as you view what you search for, while audio streaming platforms users listen to a broader range of songs from album cuts to playlists tunes.

Because of these points, we went by the conservative ratio on YouTube, so that we erase the impact of audio streams among YouTube views, and instead we will consider the 50 million users from YouTube Music as part of the extrapolation from Spotify.

Ultimately, we are left with a pack of global platforms which add for 649 million users, 406 million from Spotify and 243* million from the remaining ones.

* 78+68+50+16+6+10+15 = 243

Conclusion

Once we put all pieces together in our quest to best reflect how market shares evolve, we can apply the following update to our main formula of streaming to sales conversion.

Old method:

Equivalent Albums Sales (EAS) = ( Spotify * 310/207 + Genie * 3.05*2 + AWA * 100/5.5 ) / 1500 + ( QQ views* 50(or 5) + YouTube ) / 11750

New method:

Equivalent Albums Sales (EAS) = ( Spotify * 649/406 + Genie * 2.20 * 2 + AWA * 68/4 + Anghami + Audiomack + Boomplay) / 1500 + ( QQ views* 50(or 5) + YouTube * 1.1 ) / 6750