Drake albums and songs sales

Many artists would dream to hit 10 million streams on Spotify with a unique song. Drake did it with more than 400 tracks.

His productivity is insane, and the way he manages to be successful with everything he releases is just as amazing. We review his one of a kind numbers.

The Big Picture: Drake’s Career

After having spent his younger years acting in the Canadian TV series Degrassi, Drake jumped into the typical route, that many rapper do.

He began independently releasing mixtapes, an EP and then ultimately signing with a major label, which happened in 2009, after the success of his mixtape So Far Gone earlier that year.

The Canadian artist is well known for being basketball team Toronto Raptors, number one fan. Ironically, Drake followed exactly the same path as the former star of the team, DeMar DeRozan.

A mere four days before signing for the Young Money label, owned by Lil Wayne, DeMar DeRozan was drafted by the Raptors. In the same way that DeRozan became big inside the NBA in 2010, going from 8 to 17 points per game, Drake went from a Gold EP in the US, to his first Platinum album Thank Me Later, in 2010.

From 2011 to 2015 DeRozan kept growing slowly until reaching All-Star status. From 2011 to 2015, the success of Drake remained consistent too.

At the start of the 2016 season, the Toronto shooting Guard stepped up strongly, with a 34 point average over the first 7 games. This was also the year of Drake‘s definitive breakthrough, with his Views album adding a new dimension to his career, by breaking out on a worldwide scale.

Since then, he kept releasing material, no less than 7 albums and tons of stand-alone hits plus features, so much that it gets difficult to get a clear view of his relevance.

What we believe to be true about an artist success, is not always translated into numbers too. While we have PER – Player Efficiency Rating – for basketball players, we had no valid indicator to accurately rate music stars.

That was until, we here at ChartMasters introduced to you the Commensurate Sales to Popularity Concept! We’ll now apply it to the subject of today, Drake!

ChartMasters’ method: the CSPC

As usual, I’ll be using the Commensurate Sales to Popularity Concept (CSPC) in order to relevantly gauge the act’s results. It will not only bring you sales information for all albums, physical and download singles, as well as audio and video streaming. In fact, it will really determine the act’s popularity.

If you are not yet familiar with the CSPC method, below is a nice and short video of explaining the concept. I recommend watching it before reading on and to the sales figures. You’ll get the idea in just two minutes.

And if you want to know the full method as well as formulas, you can read the full introduction article.

Now let’s get into the artist’s detailed sales figures!

Drake Album Sales

Updated Studio Album Sales & Comments

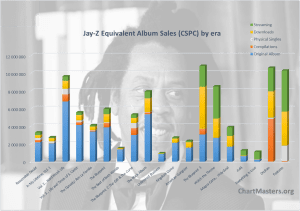

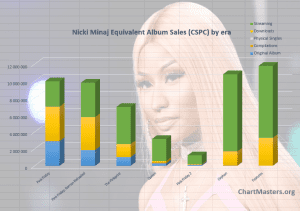

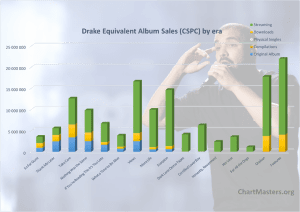

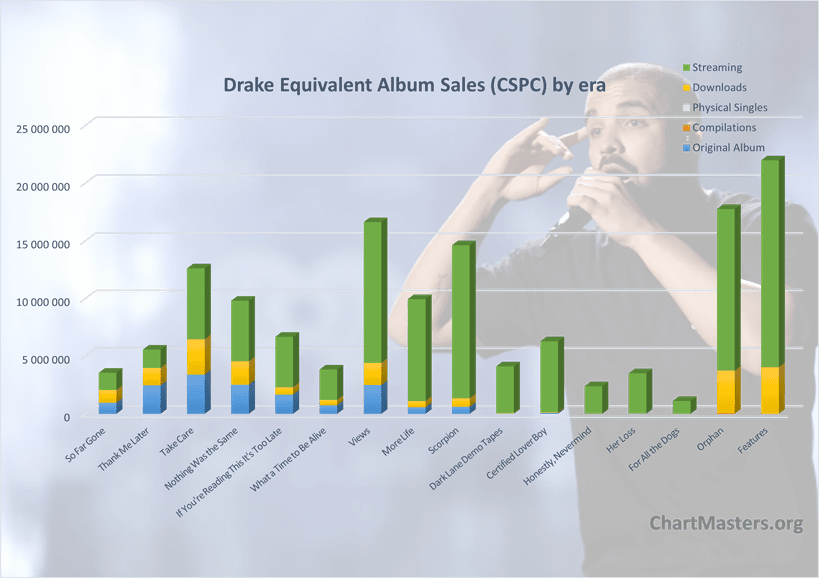

At nearly 15.5 million units sold across five studio albums, one playlist and four mixtapes, that we will be considering as valid albums as per their length, sales of Drake studio albums aren’t the most impressive we’ve met so far.

Maybe even more negative is how Views is far from being utterly bigger than his past albums, in fact it sold even easily less than Take Care and the same amount of copies than both Thank Me Later and Nothing Was the Same.

In the same line, Scorpion sold significantly less than Views, while all projects since Dark Lane Demo Tapes are selling next to nothing.

Most of the releases since More Life got no physical release at all though, which shows the artist and his label are betting their money elsewhere.

In fact, our CSPC analysis made us understand that we may not jump into conclusions too fast.

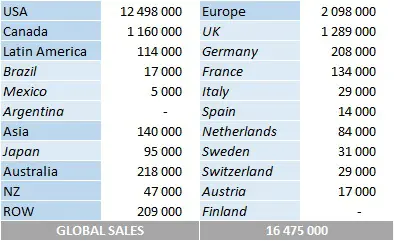

To judge Drake‘s album sales, one needs to consider he sold almost exclusively in North America up to Views. A pure urban artist, he managed to cross over the general audience thanks to this effort that opened him the door of many countries he hadn’t explore before.

Selling routinely 2,5 million units of his studio LPs to this restricted audience is already way more impressive. His mixtapes sales are just superb since this format is usually fully ignored by the public.

If results viewed that way are great, it is still not the main fort of Drake as we are going to see below.

Drake songs sales

Below, we list down results from the artist through physical sales, digital sales and streaming.

Please be aware that when the artist is regarded as the lead act, he is rewarded with 100% of these units, while featured acts share among them a 50% piece of the totals.

Physical singles

As a reminder, the weighting is done with a 10 to 3 ratio between one album and one physical single.

As many of you may expect, Drake never stepped into the physical singles market, hardly selling anything in this format.

By his debut in 2009, the US market was dead for 7 years. Now that he broke German or French markets in 2016, the physical market has been dead there for some years too.

As for most artist a few collectors came out still with mostly irrelevant numbers.

Digital songs

As a reminder, the weighting is done with a 10 to 1,5 ratio between one album and one digital single.

From 2009 to 2011, Drake had no global hit. His success in the US was undoubtable though and moderate to great hits got accumulated at an incredible speed.

His breakthrough hit was Best I Ever Had, which back then also enjoyed a decent ringtones market. It’s up to over 5 million sales to date.

Then, his first two LPs generated a total of 10 distinct million selling songs and all their album tracks did well too.

The Motto and Take Care are past 4 million sales, while Over, Find Your Love and Headlines are around 3 million a piece.

Take Care album is home for total download sales north of 20 million singles, worth 3 million equivalent album sales.

This intermediate period wasn’t well structured around one specific album.

By 2013, Drake had already understood that the concept of the album itself was dying. As a result, he started dropping mixtapes at fast pace, plus tons of collaborations that are listed as orphan songs or features.

Hold On, We’re Going Home is the biggest hit of that period extracted from those studio albums, it moved 4.6 million units.

Both 2015 mixtapes got good hits in the US but with more modest numbers elsewhere. The strongest was Jumpman at 1.7 million.

In 2016, the singer exploded globally thanks to songs Hotline Bling and One Dance. It may come as a surprise to see that they only sold 4 million units each.

The collapse of downloads in favor to streams limited their impact.

In the same vain, God’s Plan has been a monster #1 smash in many places, but downloads were ever weaker by 2018. It’s up to 1.8 million. Both Nice for What and In My Feelings were huge hits as well.

As previously mentioned, Drake issued tons of stand alone tracks while also featuring on many hits.

Forever, Bedrock and What’s My Name sold over 6 million each. Work, F**kin’ Problems, Right Above It and Moment 4 Life all top 3 million.

On top of that, 16 more orphan and featured songs are million sellers.

It reflects something crucial here, more than sales of a unique track, the key element is the unreal volume of Drake‘s catalog. It may seem easy to participate in hundreds of songs, but to do it without losing momentum is insane.

At the end of the day, the Canadian superstar has sold a tremendous total of 172 million units of downloads and ringtones.

This figure may seem unbelievable considering his top singles are around 6 million units. As mentioned, his consistency and his activity over many years have been unmatched.

In fact, Drake is already and far and away the artist with the most entries in the US Hot 100 Singes Chart. He took that incredible distinction when he reached 126 charting hits in August 2016 – a mere seven years after his debut. He went on to increase this record to 321 charting hits so far.

Streaming

Streaming is made up of audio and video streams. Our CSPC methodology now includes both to better reflect the real popularity of each track. The main source of data for each avenue is respectively Spotify and YouTube.

To factor in the growing impact of multiple Asian countries where these platforms aren’t always the go-to site for music streaming, more sources have been added.

In order to account for their real popularity in each relevant country, the below sources have been used along with the mentioned ratios that reflect the market share of each area.

Audio Streams

– South Korea: Genie streams * 2.20 (consistent with Gaon streaming numbers)

– Japan: AWA streams * 100 / 4 (AWA has 4% of the Japanese streaming market)

– Arabic world: Anghami streams

– Sub-Saharan Africa: Boomplay + Audiomack streams

– Elsewhere: Spotify streams * Spotify market shares based on artists’ market distribution

Video Streams

– China* : QQ video streams * 50 if the song is available for audio stream, QQ video streams * 5 elseway (scale built based on known figures for several major artists)

– Elsewhere : Youtube views increased by 10% to account for various local platforms

*since Chinese streaming platforms are mostly video streaming platforms, their streams are weighted on par with YouTube streams.

Audio Stream value – 1,500 plays equal 1 album unit

Video Stream value – 6,750 views equal 1 album unit

Equivalent Albums Sales (EAS) = ( Spotify * ArtistRatio + Genie * 2.20 + AWA * 100 / 4 + Anghami + Boomplay + Audiomack ) / 1500 + ( QQ views* 50(or 5) + YouTube * 1.1 ) / 6750

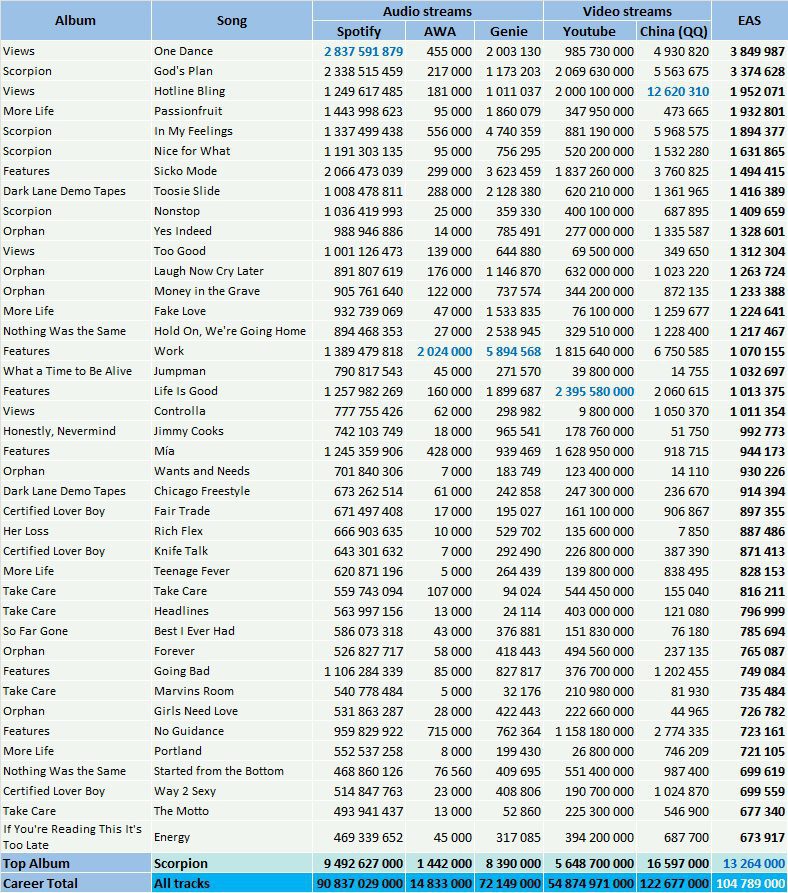

Top Hits

To make it simple, each of these 40 songs would be the signature song of most artists. The streaming success of Drake is out of this world.

One Dance, blocked for long on YouTube, is now over 2.8 billion Spotify streams. It’s one of the rare songs which has been the most streamed of all-time on the platform at some point, it has since been dislodged by Ed Sheeran‘s Shape of You which was itself topped by The Weeknd‘s Blinding Lights.

God’s Plan is ever closer, itself over 2 million EAS from streams. This one enjoyed a full availablility on YouTube where it recorded over 2 billion views.

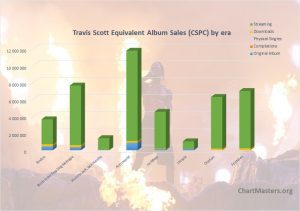

Several features are very strong in spite of being downgraded, they include Sicko Mode led by Travis Scott, Work by Rihanna, Bad Bunny‘s MIA, and Future hit Life Is Good.

In My feelings, Hotline Bling, Nice For What and Passionfruit are also phenomenal performers, each with more than 1.6 million EAS.

While Dark Lane Demo Tapes was supposed to be a minor mixtape, the 2020 track Toosie Slide posts incredible numbers as well with 1 billion streams on Spotify. It proved that the artist strength remains huge.

More recent tracks make this stacked top 40, including 3 from Certified Lover Boy, while Jimmy Cooks and Rich Flex are climbing fast.

The hip-hop icon has massive tracks from all his releases, and no matter if he pairs with Lil Wayne, Future, Rihanna, DJ Khaled, Meek Mill, Chris Brown, etc., he smashes.

The most stunning results may be totals as Drake now claims over 90 billion streams on Spotify, near 55 billion on YouTube and 105 million equivalent album sales from streams.

Full catalog breakdown

If you are familiar with the artist’s catalog and want to check details of each and every song, you can access to all of them right here.

Keep yourself up to date

Our website provides you a fantastic tool which fetches updated Spotify streams as you request them, use it to watch these results grow day after day!

Want to compare Drake’s songs with other top hits?

Drake compilations sales

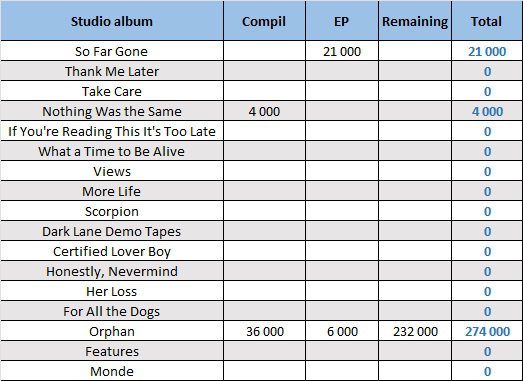

Compilations sales figures listing

Full Length related records Sales – Summary

As most of Drake EPs and mixtapes are made of tracks unreleased in his studio albums, their sales are mainly allocated to the orphan folder.

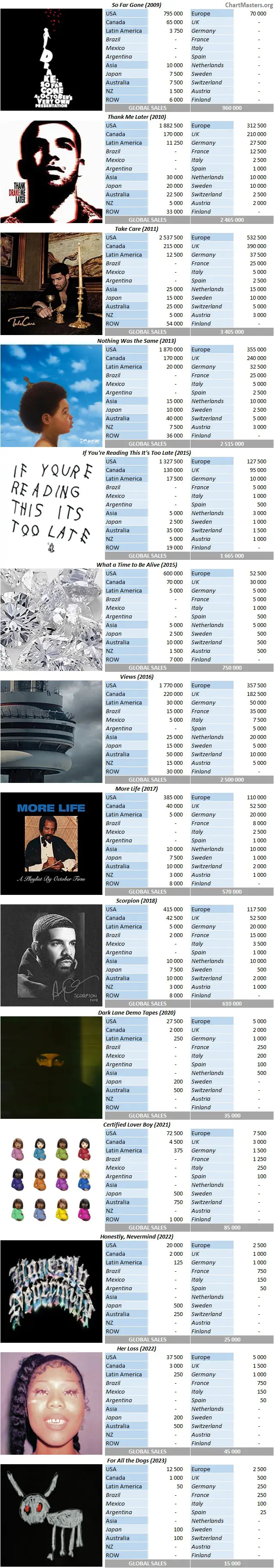

Total Album (all types) Sales per Country

Please note that some of the countries totals may be slightly incomplete when the figure is N/A for minor releases.

Drake Career CSPC Results

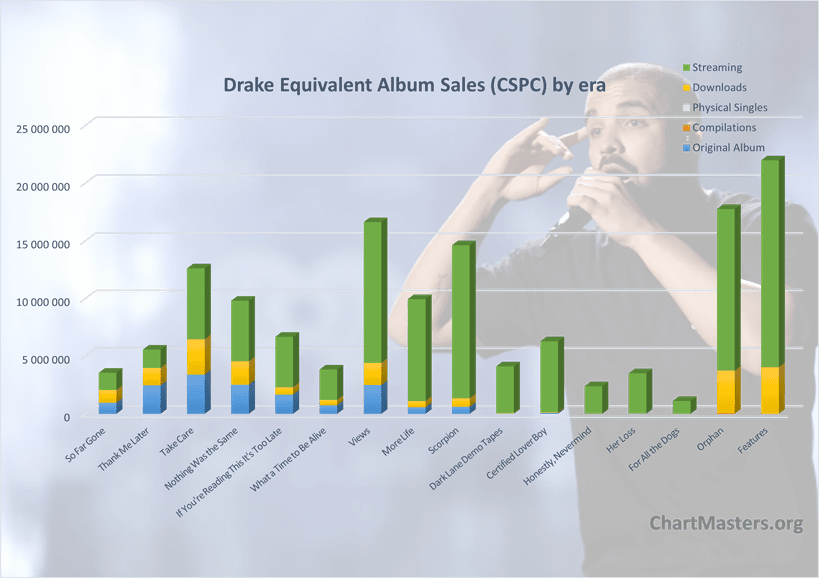

So, after checking all the figures, how many overall equivalent album sales has each Drake album achieved? Well, at this point we hardly need to add up all of the figures defined in this article!

Albums CSPC results

In the following results table, all categories display figures in equivalent album sales. If different, pure sales are listed between parentheses.

As a reminder:

- Studio Album: sales of the original album

- Other Releases: sales of compilations generated thanks to the album

- Physical Singles: sales of physical singles from the album (ratio 3/10)

- Download Singles: sales of digital singles from the album (ratio 1,5/10)

- Streaming: equivalent album sales of all the album tracks (ratio 1/1500 for Audio stream and 1/6750 for Video stream)

Artist career totals

See where the artist ranks among remaining singers

This is it ! If pure album sales aren’t enough to validate the fact that Views is Drake biggest album to date, this turns out to be very clear after adding in all pieces of the jigsaw. Closing in 17 million, the album is one of the biggest releases in recent years.

Scorpion has been a tremendous beast as well, now at 14.6 million, just like Take Care, which stands at 12.6 million.

Both albums Nothing Was the Same and More Life are now virtually at 10 million too.

Starting from the former, Drake scored 5 consecutive albums with 10 million sales or more once we exclude mixtapes and collaborative albums.

While his discography has been impressively consistent, Certified Lover Boy felt like a lackluster album. It kept amassing streams though, already claiming over 6 million units.

Both Her Loss (3.5 million) and For All the Dogs register good numbers considering how recent they still are.

In some months, once the latter grow while weaker performer Honestly, Nevermind climbs, each of his 14 projects will be over 2.5 million sales.

His total from orphan songs is massive too at almost 18 million. Then, features combine for an even bigger 22 million. Getting Drake on a track is like striking gold.

Out of all sales figures, the most oustanding one is that Drake has now sold over 140 million equivalent album units through all formats.

How much is he increasing? He scores organically 30 million Spotify streams per day with his lead songs alone. With features, this equals to well over 300,000 album sales every week thanks to streams alone.

Singles CSPC results

The list is compiled in album equivalent sales generated by each song. Therefore, these figures are not merged units of singles formats. Instead, it includes the weighted sales of the song’s physical single, download, ringtone and streaming. Also included is its share among sales of all albums on which it is featured.

Discography results

Thanks to our new ASR (Artist Success Rating) concept, we know that sales represent 22.43 million times the purchase of entire discography. Coupled with total sales, it translates into an ASR score of 303. The ranking of all artists studied so far is available too at this link.Records & Achievements

- Drake is the most streamed artist ever on Spotify with 88.3 billion streams, including 67.4 billion lead.

- Drake has the most ever lead songs over 100 million streams on Spotify with 171.

- With 10.2 million albums sold in the US in the 10s, Drake is the second best selling male artist of the decade behind Justin Bieber.

- At 16,615,000 EAS, Views is the 2nd most successful album from 2016.

- At 14,608,000 EAS, Scorpion is the 3rd most successful album from 2018.

- At 244 million, Drake is the highest certified artist ever in the US for digital singles.

- At 321, Drake has the most US Hot 100 hits ever. Runner up (Taylor Swift) is at 212.

- At 199, Drake has the most Top 40 US hits ever. Runner up (Taylor Swift) is at 119.

- At 76, Drake has the most Top 10 US hits ever. Runner up (Taylor Swift) is at 42.

- At 41, Drake has the most Top 5 US hits ever. Runner up (The Beatles) is at 29.

- Drake previously broke the record of the most simultaneous hits charted inside the Hot 100 on May 21, 2016 with 20, on April 8, 2017 with 24, then 27 on July 14, 2018.

- At 431 weeks, Drake holds the record of the longest run inside the Hot 100 from May 29, 2009 to August 19, 2017.

- On december 12, 2016, One Dance was the first song ever to hit 1 billion streams on Spotify.

NB: EAS means Equivalent Album Sales.

Dynamic Spotify Key Performance Indicators

Drake

Current followers count: 86,797,565 86,000,000 followers have been reached on 04/02/24 85,000,000 followers have been reached on 03/10/24 84,000,000 followers have been reached on 02/17/24 83,000,000 followers have been reached on 02/11/24 84,000,000 followers have been reached on 01/18/24 83,000,000 followers have been reached on 12/05/23 82,000,000 followers have been reached on 11/16/23 81,000,000 followers have been reached on 10/25/23 80,000,000 followers have been reached on 10/19/23 81,000,000 followers have been reached on 10/09/23 80,000,000 followers have been reached on 09/20/23 79,000,000 followers have been reached on 08/27/23 78,000,000 followers have been reached on 08/04/23 77,000,000 followers have been reached on 07/07/23 76,000,000 followers have been reached on 06/10/23 75,000,000 followers have been reached on 05/11/23 74,000,000 followers have been reached on 05/08/23 75,000,000 followers have been reached on 05/05/23 74,000,000 followers have been reached on 04/15/23 73,000,000 followers have been reached on 03/15/23 72,000,000 followers have been reached on 02/15/23 71,000,000 followers have been reached on 01/16/23 70,000,000 followers have been reached on 12/21/22 69,000,000 followers have been reached on 11/25/22 68,000,000 followers have been reached on 10/26/22 67,000,000 followers have been reached on 09/23/22 66,000,000 followers have been reached on 08/07/22 65,000,000 followers have been reached on 07/09/22 64,000,000 followers have been reached on 06/11/22 63,000,000 followers have been reached on 05/01/22 62,000,000 followers have been reached on 03/20/22 61,000,000 followers have been reached on 02/15/22 60,000,000 followers have been reached on 01/07/22 59,000,000 followers have been reached on 12/01/21 58,000,000 followers have been reached on 10/21/21 57,000,000 followers have been reached on 09/08/21 56,000,000 followers have been reached on 07/27/21 55,000,000 followers have been reached on 06/07/21 54,000,000 followers have been reached on 04/02/21 53,000,000 followers have been reached on 02/20/21 52,000,000 followers have been reached on 01/14/21 51,000,000 followers have been reached on 11/29/20 50,000,000 followers have been reached on 10/12/20 49,000,000 followers have been reached on 08/25/20 48,000,000 followers have been reached on 07/19/20 47,000,000 followers have been reached on 06/14/20 46,000,000 followers have been reached on 04/30/20 45,000,000 followers have been reached on 04/29/20 >> Daily breakdown

Drake is #6 among the most followed artists of all-time >> Visit our Top 5,000 most followed artists ranking

Current streams count: 74,786,084,206 74,000,000,000 streams have been reached on 04/01/24 73,000,000,000 streams have been reached on 03/06/24 72,000,000,000 streams have been reached on 02/10/24 71,000,000,000 streams have been reached on 01/19/24 70,000,000,000 streams have been reached on 12/26/23 69,000,000,000 streams have been reached on 12/02/23 68,000,000,000 streams have been reached on 11/10/23 67,000,000,000 streams have been reached on 10/20/23 66,000,000,000 streams have been reached on 10/07/23 63,000,000,000 streams have been reached on 09/17/23 62,000,000,000 streams have been reached on 08/22/23 61,000,000,000 streams have been reached on 07/25/23 60,000,000,000 streams have been reached on 06/27/23 62,000,000,000 streams have been reached on 06/25/23 56,000,000,000 streams have been reached on 06/16/23 59,000,000,000 streams have been reached on 05/31/23 58,000,000,000 streams have been reached on 05/01/23 57,000,000,000 streams have been reached on 04/01/23 56,000,000,000 streams have been reached on 02/28/23 55,000,000,000 streams have been reached on 01/28/23 54,000,000,000 streams have been reached on 12/31/22 53,000,000,000 streams have been reached on 12/09/22 52,000,000,000 streams have been reached on 11/13/22 51,000,000,000 streams have been reached on 10/22/22 50,000,000,000 streams have been reached on 09/11/22 49,000,000,000 streams have been reached on 08/06/22 48,000,000,000 streams have been reached on 07/01/22 47,000,000,000 streams have been reached on 05/31/22 46,000,000,000 streams have been reached on 04/14/22 45,000,000,000 streams have been reached on 02/28/22 44,000,000,000 streams have been reached on 01/12/22 43,000,000,000 streams have been reached on 11/25/21 42,000,000,000 streams have been reached on 10/15/21 41,000,000,000 streams have been reached on 09/15/21 40,000,000,000 streams have been reached on 08/28/21 39,000,000,000 streams have been reached on 07/04/21 38,000,000,000 streams have been reached on 04/21/21 37,000,000,000 streams have been reached on 03/23/21 36,000,000,000 streams have been reached on 02/03/21 35,000,000,000 streams have been reached on 12/05/20 34,000,000,000 streams have been reached on 10/15/20 33,000,000,000 streams have been reached on 09/04/20 32,000,000,000 streams have been reached on 07/17/20 31,000,000,000 streams have been reached on 05/27/20 >> Daily breakdown

Drake is #2 among the most streamed artists of all-time Popularity Rating: /100 >> Visit our Top 1,000 most streamed artists ranking >> Visit our Top 20 highest rated artists ranking

Current monthly listeners: 80,779,779 (Trend: -2,665,166) Global chart position: #5 The artist top 50 cities come from 18 distinct countries >> Global impact breakdown

As usual, feel free to comment and / or ask a question!

Sources: IFPI, Spotify, YouTube, Discogs, Billboard.

You may be interested in…

… Drake‘s streaming masters analysis

… checking out the upcoming artists or even voting for them!